China-India Brief #228

July 14, 2023 - July 27, 2023

Centre on Asia and Globalisation

Lee Kuan Yew School of Public Policy

Published Once a Month

Guest Column

The improving performance of India’s electronics manufacturing sector has been a topic of intense policy interest in the country. Electronics exports saw a spectacular growth of almost 50 percent in FY23, reaching $25.3 billion. Electronics is now India’s sixth largest merchandise export, overtaking readymade garments. Encouraged by these successes, the Indian government is confident of achieving its target of $140 billion in electronics exports and 1 million new jobs by FY26.

This sector’s success is now portrayed as a vindication of the Indian government’s flagship industrial policy instrument: the Production Linked Incentive (PLI) scheme. Policy debates surrounding the PLI have primarily focused on its design, effectiveness, and potential pitfalls. But the elephant in the room is the crucial role of Chinese companies in India’s electronics manufacturing story.

I argue that achieving stated targets in electronics manufacturing requires a ‘re-coupling’ between Indian and Chinese businesses on three dimensions: chips, investments, and talent. This is troubling for India since a stated reason behind government intervention in this sector was to reduce its import dependence on China.

Chinese Chips

Chips, or integrated circuits (ICs) are India’s eighth-biggest import item by value. ICs are a core component in all electronics. In a typical smartphone for instance, chips can comprise over 50 percent of the Bill of Materials.

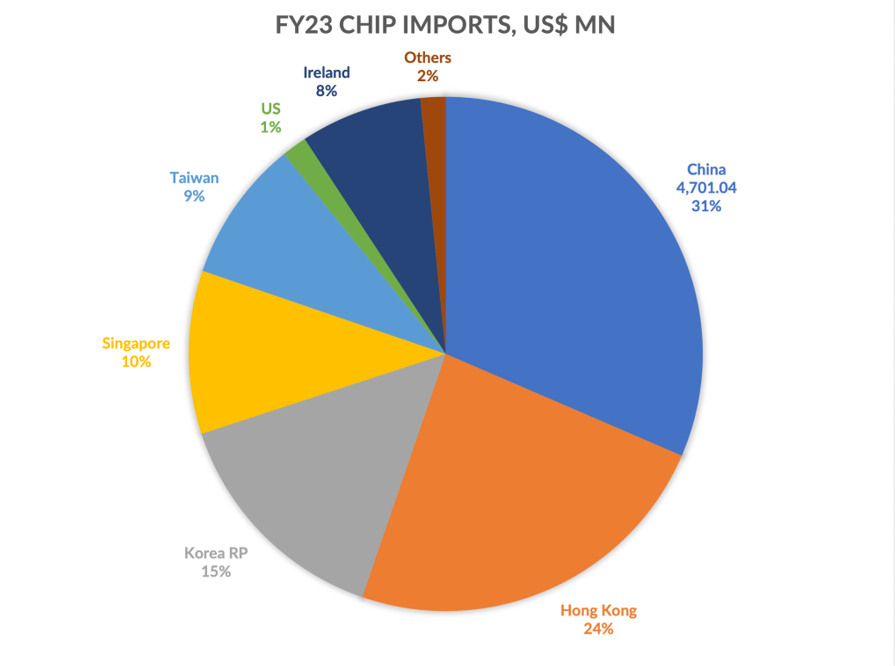

India imports a significant proportion of its ICs from China. As shown in Figure 1, China and Hong Kong accounted for around 55 percent of India’s total IC imports by value in FY23.

Figure 1. India’s foreign chip imports for FY23. Based on data from the Ministry of Commerce and Industry, Government of India

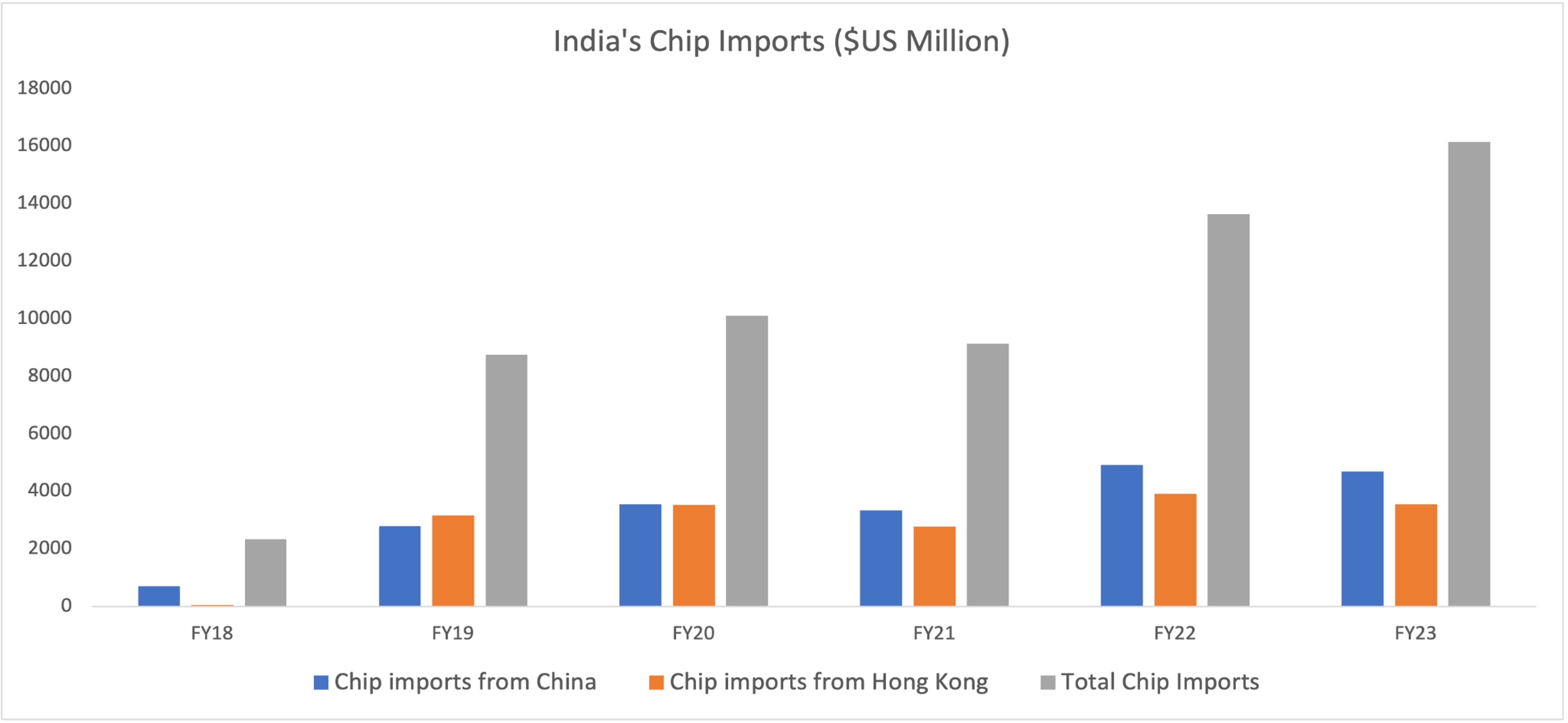

Figure 2 shows the trend of India’s chip imports over the last six years. Here again, the role of imported chips from China is evident.

Figure 2. India’s foreign chip imports FY18-23. Based on data from the Ministry of Commerce and Industry, Government of India

India has been increasing its chip imports from all countries, including from China. This trend indicates that more electronic device assembly is happening in India. A country will only import chips in large quantities if it has a vibrant downstream domestic equipment manufacturing ecosystem. As more Samsung, Apple, Dell, or Redmi devices get assembled in India, chip imports to the country will only rise further. As such, for substantial import substitution through domestic chip manufacturing to take place in India, even in the most optimistic scenario, will require at least a decade.

These figures have sounded alarm bells in Indian strategic circles, prompting the push for tighter controls over imports from China. However, such measures are unnecessary and counterproductive for three reasons. First, chips imported from China are not necessarily ‘Chinese’ chips. China is a much bigger player in outsourced assembly and packaging of chips than in fabrication. So, it’s highly likely that many of the packaged chips that India buys from China were originally fabricated as dies (unpackaged chips) in other countries, such as Taiwan or South Korea. Moreover, even if the chips were indeed fabricated and packaged within China, the work could actually have been done by foreign companies with facilities in China (such as Samsung, UMC, and SK Hynix), rather than ‘Chinese’ companies per se.

Second, chip dependence on China is not a strategic vulnerability. As long as multiple alternative suppliers are available outside China—which is the case for most commodity chips—the dependence fails to translate into a tool of statecraft that China can deploy against India.

Finally, for India’s own chip assembly and packaging to take off, the frictionless import of unpackaged chips without barriers is imperative. Thus, there is no avoiding the continued import of chips from China over the next few years.

Chinese Investments

Let’s turn to the significance of Chinese investments in Indian electronics manufacturing. In April 2020, the Indian government changed its foreign direct investment (FDI) policy, making prior approval mandatory for foreign investments from India’s neighbouring countries—a move likely aimed at China. While there are understandable national security reasons for such a decision, the move negatively impacts the growth of India’s electronics manufacturing sector as Chinese companies are crucial players in the ecosystem.

For instance, look at the Apple ecosystem, which alone accounts for over 50 percent of mobile exports from India. Apple outsources all its manufacturing. Of the 188 companies in its supplier list, 151 are Chinese or have a substantial manufacturing presence in China. The only way for Apple to shift a part of its supply chain to India is to get its Chinese suppliers to invest there. But the FDI restrictions have thrown a spanner in the works. In 2021, Apple's attempt to get its largest vendor, the Chinese manufacturing conglomerate BYD, to assemble iPads in India, failed because of New Delhi’s restrictions on Chinese investment.

Since then, the Indian government has tried to make some concessions to Apple. In January 2023, New Delhi gave initial approval for the entry of around a dozen of Apple’s Chinese suppliers, but on the condition that they had to enter into joint ventures with Indian partners, and that the latter would have to be given a majority stake. However, this change has not led to a major rekindling of investor interest.

Similarly, when Chinese mobile phone manufacturers in India came under fire from the Indian government for not exporting enough and not utilising more local suppliers, they responded that the FDI restrictions made it difficult for them to bring in their Chinese component suppliers to set up shop in India.

Discouraging Chinese investments in this sector will only mean higher imports of components. Assemblers will pay back a major chunk of industrial policy incentives as import tariffs to the Indian government, without really improving their global competitiveness.

If India wants to occupy a central role in electronics manufacturing, it will have to reconsider its view on investments from China, at least in the non-strategic areas.

Chinese Talent

Chinese talent is another crucial element of the global electronics supply chain. After the Galwan Valley clashes, the Indian government introduced new restrictions that made it difficult for Chinese businessmen, academics, industry experts, and advocacy groups to obtain Indian visas. While this might be justifiable from a national security perspective, the move has adversely affected Taiwanese companies trying to scale up manufacturing operations in India. Here too, the Indian government will have to strike a balance between geopolitical concerns and its manufacturing ambitions.

Confronting Trade-offs

India’s predicament in electronics manufacturing reflects the complexity of this supply chain. It is challenging to indigenise all stages of electronics manufacturing. External dependencies for intermediate goods, specialised equipment, international talent, and critical materials will continue to remain even when the final product is made in India. And because China is a central node in the electronics manufacturing supply chain, de-coupling from these entities will be counterproductive for India’s manufacturing ambitions.

In this author’s view, the Indian government needs to make two shifts in its policy approach to China.

One, distinguish between the Chinese government and Chinese businesses. Indeed, the Chinese Communist Party’s (CCP) controlled economy means that Chinese businesses have less agency than their counterparts in the US or India. It is also true that China’s aggression on the border and adversarial positions at multinational fora show that it sees a growing India as a threat, not an opportunity. However, it is also important to note that Chinese businesses—especially suppliers to other multinationals—have different incentives than the CCP. Outside a narrowly defined set of strategic sectors such as defence and telecommunications equipment, investments by such businesses in India is a net positive.

Chinese investments can also give India foreign policy leverage. Economist Swaminathan Aiyar’s recommendation that “massive foreign investment is a bigger risk for the foreigner than the investee country. So, let us attract as much Chinese investment as possible, since the main risk will be theirs, not ours,” needs deeper deliberation beyond simplistic binaries.

Two, the Indian strategic establishment needs a sharper definition of what constitutes ‘strategic.’ It is insufficient and counterproductive to define entire sectors as strategic. Not all types of chips or LCDs are strategic. Dependence on China for these items does not make it a strategic vulnerability for India.

China’s success in manufacturing was possible because it was willing to harness Western investments despite political and ideological differences. Though the India-China relationship remains complicated due to simmering tensions along their shared border, India must take a leaf out of China’s book and cautiously utilise Chinese products, investments, and talent to close the power gap.

Pranay Kotasthane is Deputy Director of the Takshashila Institution and chairs the High Tech Geopolitics Programme. He tweets at @pranaykotas.

The views expressed in the article are solely those of the author(s) and do not necessarily reflect the position or policy of the Lee Kuan Yew School of Public Policy or the National University of Singapore.

Image Credit: iStock/sefa ozel