For more than half a century, the dollar has been the world's dominant currency. However, over the past year, calls to de-dollarise the global economy have been growing.

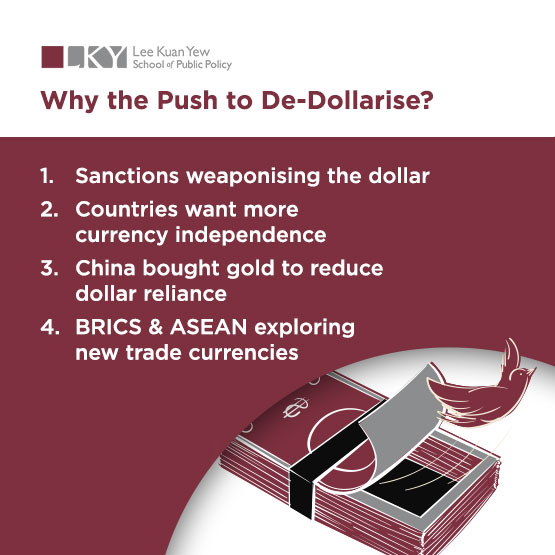

Following the war in Ukraine and amid ongoing tensions between China and the United States, the US has been using dollar-based sanctions as a policy tool, leading nations in the Global South to consider alternatives to the greenback for international trade.

In August 2023, Russian President Vladimir Putin, addressing the BRICS nations of Brazil, Russia, India, China and South Africa, said that the process of de-dollarisation was “irreversible” and “gaining pace”. While many see a move to a multi-currency world as inevitable, the pace has recently faltered.

After an 18-month gold-buying spree, China did not add to its reserves for a second straight month in June. The buy-up was part of a de-dollarisation process, increasing its stores of the precious metal over the greenback. China has the world’s largest foreign exchange reserves, at US$3.2 trillion, with most being held in dollars, according to the latest government data.

Ramkishen S. Rajan, a Yong Pung How Professor at the Lee Kuan Yew School of Public Policy (LKYSPP), believes there is a need to “be careful about the hype around de-dollarisation”.

Professor Rajan said that while the US was “weaponising the US dollar much more to deal with Russian sanctions and Chinese leaders and giving it a political angle”, de-dollarisation could also change foreign exchange markets as we know them.

“We understand why central banks or policymakers want to have de-dollarisation, but at the same time, de-dollarisation, if it's successful, implies we may move to a multi-currency world,” Professor Rajan said.

“A multi-currency world adds to transaction costs in terms of exchange rates and conversions. Economies without very deep foreign exchange markets will also face greater risks. All of these things are related,” he said.

De-dollarisation describes a process of moving to rely less on the dollar, and it has a long history. The US currency was officially crowned as the chief reserve currency in 1944 when the Bretton Woods Agreement was negotiated.

Under the agreement, gold was convertible to the dollar, and countries pegged their currencies to the value of the dollar.

That was how things worked up until the 1970s, when Richard Nixon, who was then the US President, announced that the country would no longer accept gold in exchange for dollars.

This came after a sharp jump in inflation in the US made the Bretton Woods Agreement unstable, as countries raised their reserves of foreign currencies and gold.

However, many countries have continued to peg their currencies to the dollar alone or as part of a basket of major currencies.

Pegging is a way for countries to keep their currencies stable. It ensures that the currencies will not fluctuate wildly based on demand and supply, which is good for trade as it reassures investors.

Challenges of A Strong Dollar

However, a strong dollar is challenging for many economies, including those in Asia. As the cost of imports from the US rises, so does domestic inflation.

At the same time, a lot of corporate debt in Asia is valued in dollars. If a local Asian currency depreciates against the dollar, corporate liabilities rise, causing a crunch in balance sheets.

“This happened during the Asian financial crisis and still is a problem for a lot of corporates today,” Professor Rajan said.

Strength in the dollar has also prompted an increase in domestic bond markets. Professor Rajan said this shifts foreign exchange risk to investors. This could cause investors in local currency bond markets to sell their holdings if the dollar appreciates against the local currency.

De-dollarisation Efforts

Efforts to move away from the dollar have been underway for almost two decades now.

In 2007, China, the world's second-largest economy after the US, issued its first offshore bonds that were traded in its renminbi currency.

Two years later, the Chinese Central Bank called for a global currency to replace the dollar. Its governor recommended that the new currency should be made up of a basket of existing currencies and controlled by the International Monetary Fund “to achieve the objective of safeguarding global economic and financial stability”.

In Southeast Asia, countries have also boosted their resilience around the dollar. In 2000, the Chiang Mai Initiative was established by ASEAN+3 – the ten Association of Southeast Asian Nations (ASEAN) member states as well as China, Japan, and South Korea. The arrangement theoretically gives countries a solution if they are low on dollars, by allowing them to exchange their own currencies for dollars with other countries under the initiative.

More recently, BRICS countries have reportedly discussed creating a currency for trade and investment with each other, but it is unclear if all members are on board.

Even the European Union is taking steps to tackle dollar dominance. It convened an industrial group in 2019 to come up with ways to tackle the monopoly of the dollar in oil and commodities trading.

What is the Reality?

Despite these efforts, the dollar remains dominant. It was the most common currency in global foreign exchange reserves last year – more than three times the euro, or 58 per cent to 20 per cent.

The impact of de-dollarisation efforts has also been uneven. While the influence of the next biggest economy and its currency, China and its renminbi, has become more dominant in bilateral payments involving the country, it is not necessarily at a global level.

The share of China's trade settled in Chinese yuan, or renminbi, continued to climb through the first quarter of 2024. Russia accounted for 29 per cent of that increase since 2021, according to a Bloomberg Economics estimate. The currency has weakened against the dollar in recent months, and it continues to be hampered by factors including Chinese growth prospects, a property crisis and weak consumer spending.

It is for these reasons that in the foreseeable future, many observe that the US dollar remains the leading trade in foreign exchange markets. Virtually every central bank, put in charge of monetary policy, keeps the majority of their reserves in dollars.