Many of us take identity documents for granted. It is easy for us to prove who we are and where we live. In many developing countries individuals do not have documents to prove their identity. This prevents them from accessing services provided by both the private and public sectors.

In India, a ration card, which is issued to households and lists the members of the household, is perhaps the most ubiquitous form of identification. This allows certain households, particularly the poor, to access subsidised grains, sugar, kerosene and LPG gas through the public distribution system. Financial inclusion also requires identification or what banks call the KYC (know your customer) credentials.

The ration card may be ubiquitous but it is not universal in that not every household in India has one. India has a population of about 1.22 billion people, 29% of whom live below the poverty line. In 2008, 20% of those living below the poverty line did not have ration cards. In addition, corruption and fraud are rampant in 2016, the government found 21.6 million fraudulent ration cards.

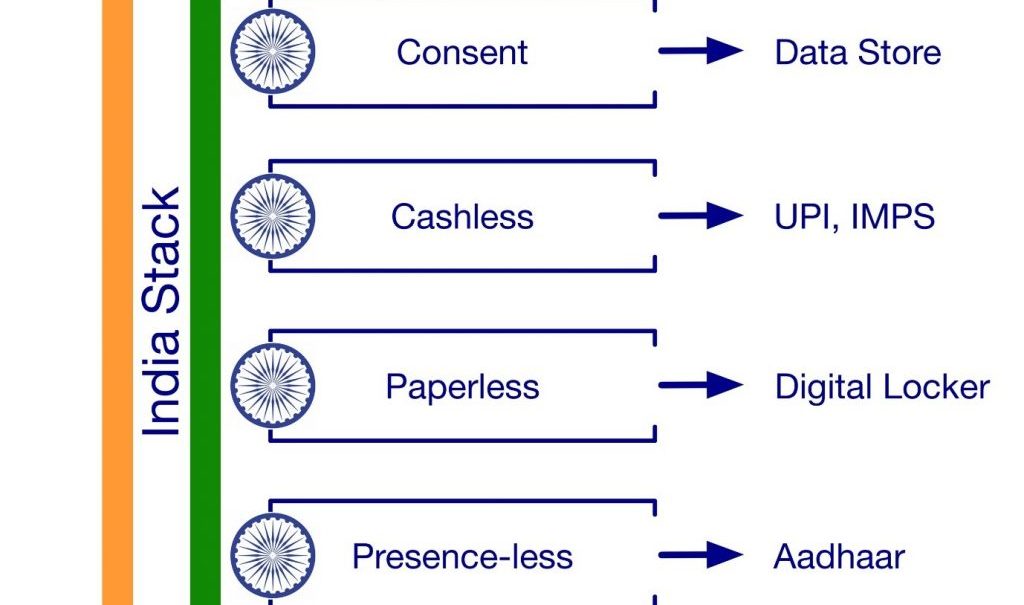

Aadhaar, which means foundation in Hindi, is the foundation of the India Stack. The intent of the program, which was initiated in 2009, is to eliminate the inefficiencies in the public distribution system as well as to facilitate the disbursement of cash transfers directly from the government to the intended beneficiaries, cutting out middlemen.

Aadhaar is an identity program for all residents of India and despite its opt-in nature, about 1.12 billion have Aadhaar identity cards today. The 12-digit card number is linked to an individual's biometric and basic demographic data including a photograph, iris scans, fingerprints, name, address, date of birth and gender. The Aadhaar number can be used in combination with any of these factors' for multi-factor authentication. The Aadhaar database containing all of this information is the largest biometric database in the world and was built using internet-scale technology. It is important to note that Aadhaar is purely an identification tool, so having an Aadhaarcard affords no privileges to an individual; unlike a driver's license for example, which allows one to drive. The goal, therefore, is to build an identity platform and allow others to build an ecosystem around it, or link services to it. The Aadhaar database can be queried (or pinged) by a bank to verify a person's identity: Is this person who they say they are? the database returns a binary (yes/no) response to the query.

The other layers in the India Stack interact with the identity (Aadhaar) layer to facilitate digitisation. Document or credential issuers can send digital documents such as birth certificates, degrees and diplomas, driver's licenses and digital medical records to the digital locker which can then be used by an individual (using the consent layer) to share documents with those who may demand them such as health insurance providers. This removes paper from the system as well as fraudulent documents. The identity layer is called presence-less because the other layers allow for an eKYC an individual could use their mobile phone to provide their Aadhaar number to a service provider and allow them to access their demographic data from the Aadhaar database.

The cashless layer facilitates mobile payments. The Immediate Payment System (IMPS) provides an immediate (and 24x7) interbank funds transfer service through mobile phones using a mobile money identifier linked to a bank account. The Unified Payment Interface (UPI) is built on IMPS and is an open source platform which uses a single virtual identifier that may be linked to multiple bank accounts as well as mobile wallets. In other words, it solves the problem of closed networks; masks customer account details; provides immediate credit and debit payments. The UPI feature set puts India ahead of countries such as the United Kingdom (Faster Payments Scheme) and Singapore (FAST). In these countries, immediate payment systems presently only accommodate push payments (or credits) through an internet banking interface and do not mask customer bank account details.

The India Stack sets up most of the infrastructure required for India's digital transformation. It provides secure identification to nearly all Indian residents hence eliminating a basic barrier to financial inclusion. It reduces transactions costs as well as fraud and paperwork. However, since it is a platform infrastructure, it's up to the private sector and the central andstate governments to use the open APIs (application programming interfaces) to find use cases and build applications which utilise the platform. This is gathering pace - with Telcos and the financial sector leading the charge.