Like the other East Asian Tigers, Singapore's development has often been described as one of "growth with equity" (World Bank 1993). Rapid GDP growth was accompanied by improvements in income distribution, rising standards of living, and significant advances in a number of social indicators, in a relatively short span of time. How did Singapore achieve this? A large part of the answer lies in fiscal policies that created the conditions for macroeconomic stability, supported economic growth, and promoted social equity.

Like the other East Asian Tigers, Singapore's development has often been described as one of "growth with equity" (World Bank 1993). Rapid GDP growth was accompanied by improvements in income distribution, rising standards of living, and significant advances in a number of social indicators, in a relatively short span of time. How did Singapore achieve this? A large part of the answer lies in fiscal policies that created the conditions for macroeconomic stability, supported economic growth, and promoted social equity.

A basic principle of fiscal policy has been to balance the budget and avoid running persistent deficits. A second principle is to keep the public sector lean and efficient. Expenditures are kept on a tight leash, with little spending on entitlements or social transfers. Balancing the budget and keeping government small mean a light tax burden on the economy.

At the same time, fiscal discipline has not been a straitjacket that constrains the government’s ability to respond to new challenges and needs. Singapore strikes a fine balance between the discipline necessary for sustainability and the discretion necessary to respond to changing demands. This combination of discipline and discretion is arguably the most important and distinctive feature of fiscal management in Singapore.

This brief examines the major features of fiscal management in Singapore to show how it has contributed to the Singapore story of growth with equity.

A medium-term orientation

Fiscal policy in Singapore is characterised by a strong emphasis on medium- and long-term objectives. It has focused more on enhancing supply side conditions to sustain growth over the long haul rather than on short-term demand management objectives. This orientation reflects both the government’s emphasis on economic growth, as well as the economic, political and constitutional contexts in which fiscal policy operates in Singapore.

Fiscal policy in Singapore is characterised by a strong emphasis on medium- and long-term objectives. It has focused more on enhancing supply side conditions to sustain growth over the long haul rather than on short-term demand management objectives. This orientation reflects both the government’s emphasis on economic growth, as well as the economic, political and constitutional contexts in which fiscal policy operates in Singapore.

The Singapore economy is extremely open and heavily reliant on imports.

First, the Singapore economy is extremely open and heavily reliant on imports. This limits the scope for counter-cyclical fiscal policy, as a large part of any fiscal stimulus would be "leaked out" through increased imports. Singapore's public spending—at less than a fifth of Gross Domestic Product (GDP)—is also very low by the standards of most developed economies. This suggests that pump-priming measures aimed at increasing aggregate demand when growth is below potential are likely to be of limited effectiveness.

Rather than employing Keynesian measures of lower taxes or higher public spending to deal with negative shocks, the government has tended to rely more on direct cost-cutting measures, especially in the form of lowering employers’ contribution rates to the Central Provident Fund (CPF), Singapore’s fully-funded social security system.

The government also puts medium-term considerations of growth and economic competitiveness above any demand management objectives. For instance, when the government cut corporate and personal income taxes and increased the goods and services tax (GST) during the slow-growth years of the early 2000s, its primary objective was to improve supply side conditions and promote growth over the medium-term.

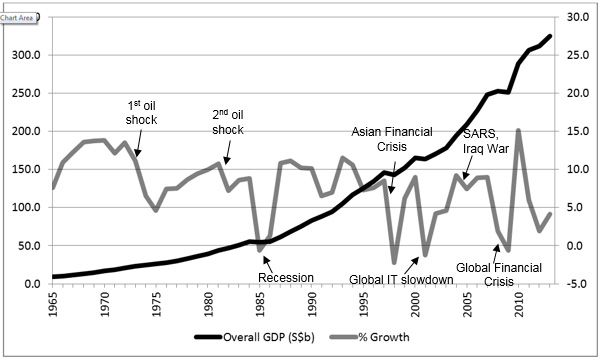

Notwithstanding the emphasis on medium-term growth, the Ministry of Finance (MOF) has become more sensitive to cyclical considerations in recent years. When Singapore experienced slower economic growth and higher volatility in the late 1990s, early 2000s and the global financial crisis of 2008/2009 (see Chart 1), the government pursued more accommodative fiscal policies, increased transfers to households, and provided various relief measures to businesses.

Chart 1: More volatile growth in the last decade

Source: Monetary Authority of Singapore, Ministry of Trade and Industry, Singapore

A second reason why fiscal policy has been oriented at medium-term objectives is the political and constitutional context in which policymakers operate. The electoral strength of the ruling party and the strong likelihood that it would remain in office over at least the medium-term has enabled the government to plan on time horizons longer than in most countries. This has insulated it from political pressures that might encourage less secure office holders to engage in short-term behaviour, such as attempting to gain votes with promises of more transfer payments while concealing the true tax costs of such transfers.

In addition, the constitutional safeguards that have been put in place since the early 1990s to protect Singapore's past reserves also limit the room for short-term discretion. In the Constitution, reserves are defined as the excess of assets over liabilities of the government. The reserves to be protected are more commonly referred to as "past reserves", or the reserves accumulated by the government in its previous terms of office. Both financial assets (loans, equity holdings, financial instruments) and physical assets (state lands and buildings) belonging to the state are protected.

The key elements of Singapore's constitutional safeguards are:

- No drawing on past reserves. Without the approval of the elected President, the current government cannot draw on resources accumulated in previous terms of government.

- The "50% of NIR spending" rule. The government of the day cannot use more than 50 per cent of the net investment returns (NIR) earned from past reserves to fund its expenditures.

- The fair market value principle. All assets forming past reserves are to be disposed at fair market value and the net proceeds must accrue to past reserves. Proceeds from the disposal of assets are therefore unavailable for spending by the government of the day.

- The "two-key" mechanism. In the event that the government needs to draw on reserves that were not accumulated in its term of office, it has to seek the consent of the elected President.

These rules on the use of reserves provide an important anchor for fiscal responsibility in Singapore. They create strong incentives for the government to err on the side of caution: to accumulate surpluses in good years during its term of office as a buffer against lean years when it may have to run budget deficits.

Objectives of fiscal policy

Singapore's fiscal policy regime aims to achieve the following:

Singapore's fiscal policy regime aims to achieve the following:

- Ensure financial discipline;

- Pursue growth;

- Redistribute with minimal distortions; and

- Manage reserves as an endowment

Ensure financial discipline

While Singapore has been highly flexible and adaptable in its conduct of fiscal policy, this flexibility has generally operated within the bounds of financial discipline.

While Singapore has been highly flexible and adaptable in its conduct of fiscal policy, this flexibility has generally operated within the bounds of financial discipline.

First, the government relies heavily on markets and on market-based mechanisms in its interventions. While it uses fiscal policy in an activist manner, the state has always tried to harness the market. For instance, tax incentives benefit profitable companies rather than subsidise loss-making ones. The government also makes use of price incentives in the form of user charges (or co-payment) to limit over-consumption and to encourage users to economise. This reliance on market mechanisms and price incentives helps to ensures that the state’s interventions do not create significant distortions.

Second, the constitutional provisions against the use of reserves create strong incentives for fiscal prudence and conservatism. The principle that each term of government must "earn its own keep" and not draw on past reserves (except with the assent of the President) constrains the size of the budget deficits the government in office can run. The government also does not have any external debt nor does it borrow for spending purposes.

Third, Singapore has kept public sector spending as a share of GDP at one of the lowest levels among developed economies. There are no universal entitlements or costly social welfare programmes. Singapore does not provide large transfer payments in the areas of old-age pensions, healthcare, unemployment or disability benefits.

Fourth, each ministry receives a "block budget" that is determined as a percentage of a "smoothened", multi-year gross domestic product. These spending ceilings are usually set for a period of five years. With these expenditure limits established, MOF allows ministries a great deal of autonomy in deciding what to spend on and how to allocate resources among competing needs.

The block budget system also provides ministries with sufficient certainty to plan and invest for the future. It has eliminated the need for spending departments to engage in protracted and unproductive budget battles with the Treasury.

Singapore has kept public sector spending as a share of GDP at one of the lowest levels among developed economies. There are no universal entitlements or costly social welfare programmes.

But while the block budget system provides ministries with the certainty of their long-term funding position, it may also reduce flexibility for the Treasury to reallocate resources as priorities change. Over time, some ministries will face rising spending needs, while others might see their budget requirements (as a share of GDP) shrink. A block budget system based only on past budget allocation patterns might prevent the government from responding flexibly to changing circumstances and future challenges.

To address this shortcoming, MOF introduced in 2004 a system of budget extractions applied to all the ministries (except for the Ministry of Defence) and redistribution of these extractions to ministries with rising spending needs or innovative projects requiring cross-agency collaboration. Under this system, MOF takes from each ministry a certain percentage of its budget entitlement and pools these funds into a Reinvestment Fund (RF). Ministries are then invited to bid for funding of their new initiatives from the RF. Projects are selected on the basis of their innovativeness, cost-effectiveness, and the extent to which they address cross-cutting issues.

Pursue growth

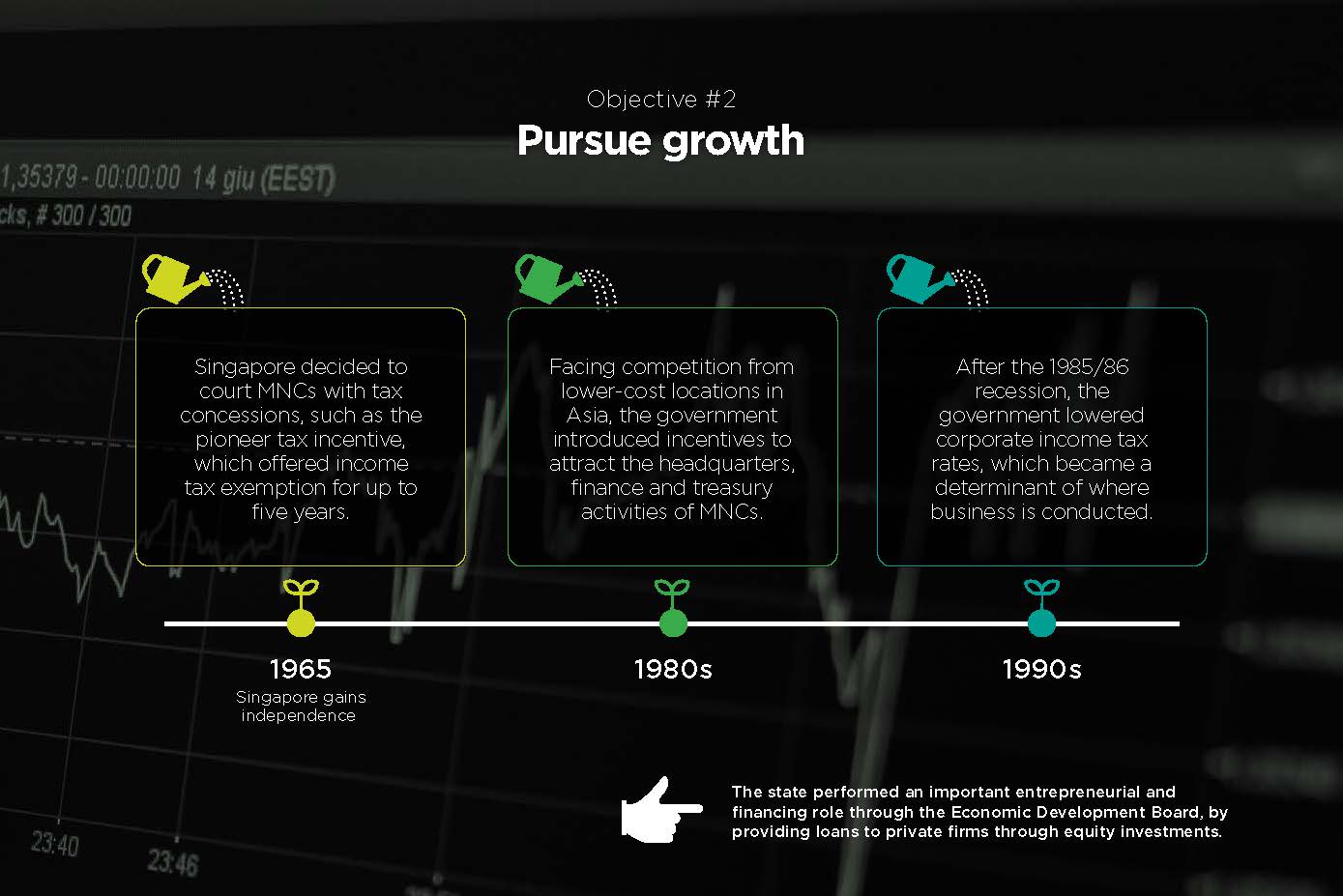

In the early years of Singapore’s industrialisation, the key measures to promote growth were the rapid development of infrastructure, the provision of tax and other incentives to attract foreign investments, and the direct participation of the government in the economy.

In the early years of Singapore’s industrialisation, the key measures to promote growth were the rapid development of infrastructure, the provision of tax and other incentives to attract foreign investments, and the direct participation of the government in the economy.

Soon after it gained independence in 1965, Singapore made the then-unfashionable decision to court multinational corporations (MNCs). The government offered financial incentives to lure companies which offered access to markets and technology and were willing to invest with a long-term perspective. The incentives were mainly in the form of tax concessions rather than cash grants. The main incentive was the pioneer tax incentive that gave the company exemption from income tax for up to five years. Further tax concessions were available in the form of accelerated plant depreciation, and deductions for interest payments on foreign loans and royalty payments.

In investment promotion, non-fiscal "virtues" were clearly just as important. For instance, Singapore succeeded in establishing a reputation for incorruptibility and trustworthiness, much like Switzerland did in Europe. Attracting MNCs with tax incentives and other fiscal measures worked only if they believed that the Singapore government will deliver on its promises. This brand of trustworthiness means reliability and dependability, observing the rule of law, and Singaporean work ethic. Just as importantly, Singapore’s ability to maintain peace and stability despite significant ethnic and religious diversity also helped in attracting investments.

In its industrialisation drive, the government did not rely solely on private initiative. Where it assessed that private sector capabilities were missing or investor confidence lacking, the state performed an important entrepreneurial and financing role. When the Singapore Economic Development Board (EDB) was formed in 1961, one of its functions was to provide loans to private firms and participate in companies through equity investments. Many of the projects the EDB invested in may not have materialised if the government had not been prepared to share in the risk.

As the Singapore economy developed, so too have the fiscal incentives to attract new investments expanded in range and sophistication.

As the Singapore economy developed, so too have the fiscal incentives to attract new investments expanded in range and sophistication. From the 1980s, faced with keener competition from lower-cost manufacturing locations in Asia, the government introduced new incentives to attract the headquarters, finance and treasury, and other business activities of large multinational companies. These measures were aimed at developing Singapore as a “total business centre” from which companies would manage their international operations.

With the advent of globalisation in the 1990s, Singapore’s tax regime has shifted to a pro-business and highly competitive one. While capital gains have always been exempt from taxation, it was only after the 1985/86 recession that the Singapore government moved decisively to lower corporate and individual income tax rates. From 40 percent in the early 1980s, the corporate income tax rate has been reduced successively to 17 percent in 2010. Meanwhile, the top marginal tax rate on individuals has come down from 55 percent in 1980 to 22 percent today. This has proved prescient. In a world of newly-liberalising economies and increasingly mobile MNCs and talent, income tax rates have become more important as a determinant of where business is conducted. At the same time, the goods and services tax (GST), introduced at 3 percent in 1994, has been raised over the years to 7 percent – in part to make up for reduction in revenues as a result of falling income tax rates.

Redistribute with minimal distortions

While Singapore’s fiscal regime has evolved to meet the changing needs of the economy and continued to support economic growth, Singapore has also experienced increasing levels of income inequality in recent years—especially in the decade after the Asian financial crisis.

While Singapore’s fiscal regime has evolved to meet the changing needs of the economy and continued to support economic growth, Singapore has also experienced increasing levels of income inequality in recent years—especially in the decade after the Asian financial crisis.

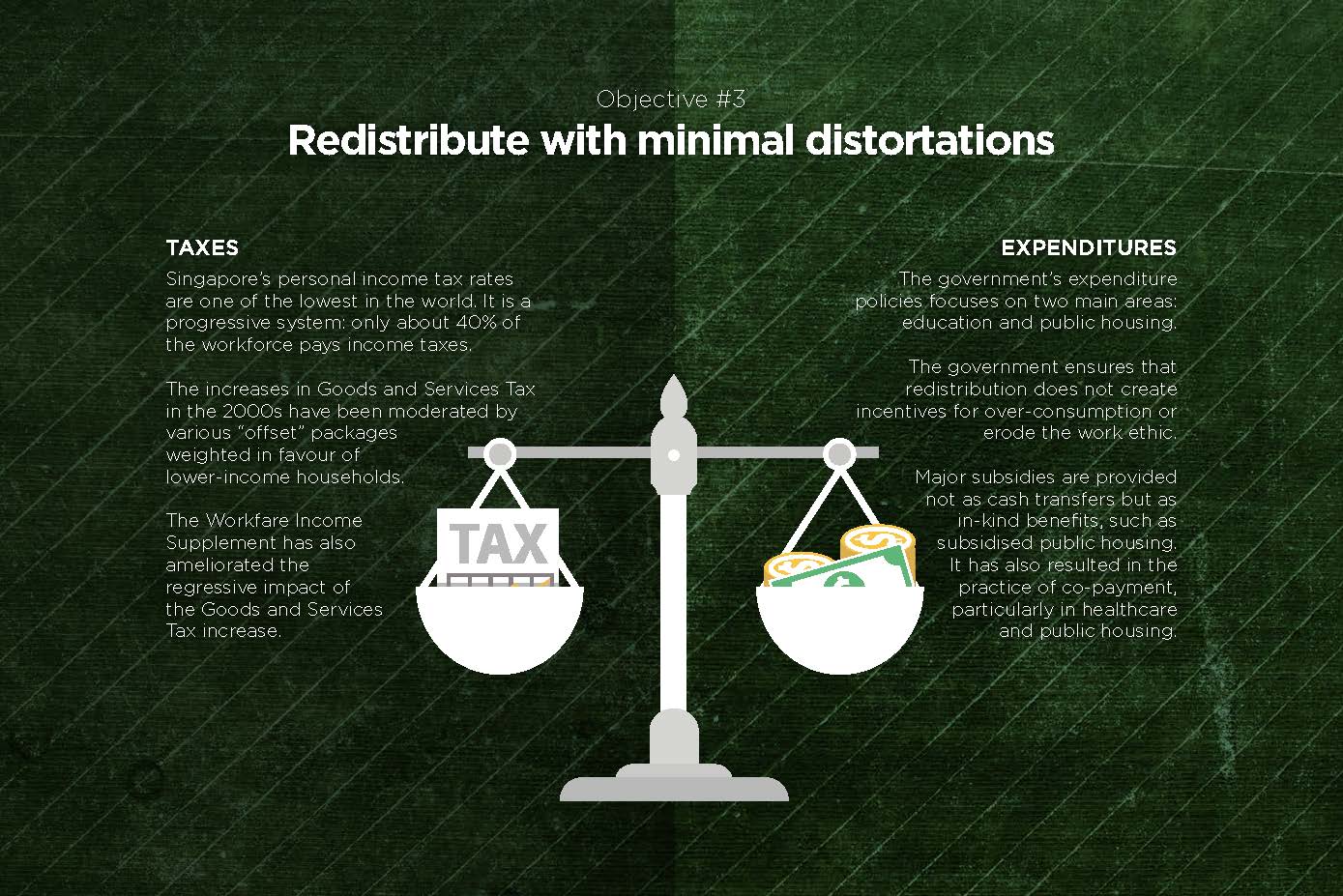

Conventional wisdom often presents economic efficiency and social equity as competing objectives, an inevitable trade-off. For the Singapore government, ensuring that the fruits of economic growth are shared had always been on its agenda. But it was also highly attuned to the pitfalls of large, government-financed entitlement programmes.

Instead of distributing large social transfers to equalise incomes, the Singapore government seeks to enhance social equity by spreading opportunities widely. On the tax side, the state imposes a relatively low tax burden on labour. Singapore’s personal income tax rates are one of the lowest in the world. It is also quite a progressive system: only about 40 percent of the workforce pays any income taxes at all.

The increases in GST in the 2000s may have made taxes on individuals less progressive, but the effects of the GST increases have been moderated by the various “offset” packages weighted in favour of lower-income households and which compensated Singaporeans for the increased GST they would have to pay. The introduction of the Workfare Income Supplement (WIS)—which augments the incomes of lower-wage workers—has also ameliorated the regressive impact of the GST increase to 7 percent in 2007.

On the expenditure side of the ledger, the emphasis has been on investing in the long-term capacity of citizens to give them the opportunities to participate in economic growth. This approach underpins the government’s expenditure policies in the two main areas where it has made the largest improvements to the livelihoods of Singaporeans—education and public housing.

The government has also sought to ensure that redistribution is done in an efficient, non-distorting way that does not create incentives for over-consumption or erode the work ethic. This approach to social spending has meant that the major subsidies are provided not as cash transfers but as in-kind benefits (e.g., subsidised public housing, education and healthcare). It has also resulted in the common practice of requiring co-payment from users, particularly in healthcare and public housing, where the (subsidised) prices are differentiated by to the actual cost of providing the services.

Manage reserves as an endowment

The government’s approach to the accumulation and management of reserves has evolved over the years. Initially, it saw the country’s financial reserves as a contingency fund, a fund set aside for “rainy days”. On other occasions, it has used the analogy of a nest-egg.

The government’s approach to the accumulation and management of reserves has evolved over the years. Initially, it saw the country’s financial reserves as a contingency fund, a fund set aside for “rainy days”. On other occasions, it has used the analogy of a nest-egg.

Increasingly though, the government has come to see the reserves as an endowment. The key characteristics of an endowment are that its principal is protected, and the returns from investing the endowment are shared between current and future generations of beneficiaries. Singapore's Constitution was amended in 1991 to provide for an Elected President to safeguard the reserves and prevent a profligate government from squandering them. In 2001, the government moved to lock up at least 50 per cent of net investment income (NII) to ensure that Singapore continues to grow its reserves and not spend all of the income on current needs.

In anticipation of growing spending needs, the Constitution was again amended in 2008 to introduce the net investment returns (NIR) framework. This allowed the government to spend on the basis of total returns, which included capital gains and not just dividend and interest income. These would also be real returns, instead of nominal returns, so as to preserve the purchasing power of the country’s reserves. Taken together, the 50 per cent NIR spending rule aims to protect (and grow) the principal while ensuring that its returns are distributed fairly across generations.

Conclusion

The conduct of fiscal policy over the last 40 years has seen a great deal of innovation and adaptation. But at a higher level of abstraction, the objectives of fiscal policy have been quite constant. The government’s pursuit of sustained economic growth has not wavered even if the policy tools by which this has been achieved have undergone significant change.

The conduct of fiscal policy over the last 40 years has seen a great deal of innovation and adaptation. But at a higher level of abstraction, the objectives of fiscal policy have been quite constant. The government’s pursuit of sustained economic growth has not wavered even if the policy tools by which this has been achieved have undergone significant change.

The emphasis on economic growth has been accompanied by measures to enhance social inclusion. The government has invested heavily in education, home ownership, healthcare and the social infrastructure to ensure that growth delivers broad-based benefits for society. But unlike most developed Western economies, these subsidies are not expressed as rights or entitlements nor are they rationalised by references to notions of social justice. Rather, they are presented as providing Singaporeans the opportunities to enhance their livelihoods and to participate in economic growth.

If growth with equity was the goal of fiscal policy, then discipline with discretion has been the means. The constitutional constraints against the use of past reserves, the requirement for the government to balance its budget over the term of its office, the expenditure limits on ministries, and the emphasis on efficiency are all manifestations of a prudent, fiscally conservative government. What the Singapore government has gained from years of fiscal rectitude is confidence and credibility, as well as the flexibility and financial resources to deal with crises (such as the one experienced in 2008/2009) and respond to longer-term challenges. As Singapore grapples with the challenges of globalisation, an ageing population and income inequality, the government’s fiscal resources, as well as its capacity for constant adaptation, will be critical assets.

References

Abeysinghe, T & Choy K M (2007), The Singapore Economy: an Econometric Perspective, Routledge, New York.

Ghesquiere, H (2006), Singapore’s Success: Engineering Economic Growth. Thomson Learning, Singapore.

Goh, K S (1977), The Practice of Economic Growth, Federal Publications, Singapore.

Lindert, P (2004), Growing Public: Social Spending and Economic Growth since the eighteenth century, Cambridge University Press, New York.

Lee, K Y (2000), From Third World to First—the Singapore Story: 1965–2000, Singapore Press Holdings, Singapore.

Rodrik, D (1998), “Why do more open economies have bigger governments?” Journal of Political Economy, vol. 106, no. 5, October, pp. 997–1032.

Tan, C H (1975), “The public enterprise as a development strategy: the case of Singapore”, Annals of Public and Cooperative Economics, vol. 46, no. 1, January, pp. 61–85.

World Bank (1993), The East Asian Miracle: Economic Growth and Public Policy, Oxford University Press, US.

Download

full publication.