"If the US turns inward perhaps because it thinks trade is letting others win while it loses emerging Asia will seek out other security arrangements, predicts Professor Quah. He adds that China can benefit from this new balance.

Last month it was a cooling manufacturer. This month it's the automakers. Thus far, the President has made good on his campaign pledges to target companies that source their labor overseas.

Mr. Trump has long proclaimed that he wants to halt offshoring by renegotiating unfair trade deals and pressuring US-based firms to repatriate their foreign operations and, more importantly, foreign jobs back to the States.

It would be convenient to dismiss much of this as political posturing. The Trump campaign was not alone in assigning blame to globalism, nor was it the first top oliticians from both parties tend to demonize trade deals rather than peddle their benefits. And despite the highly touted reversals by companies like Carrier and Ford, few would characterize a company-by-company shakedown as an effective way of weakening the forces of global trade.

Still, the bluster underscores a more concerning anti-global sentiment.

In the wake of Brexit, ascendant European nationalism, and the US elections, much has been written about populism's threat to global trade growth and the international economic institutions established after the Second World War. There are a number of explanations for the turn inward. Many have blamed growing economic inequality within developed economies some blame outsourcing or technological transition.

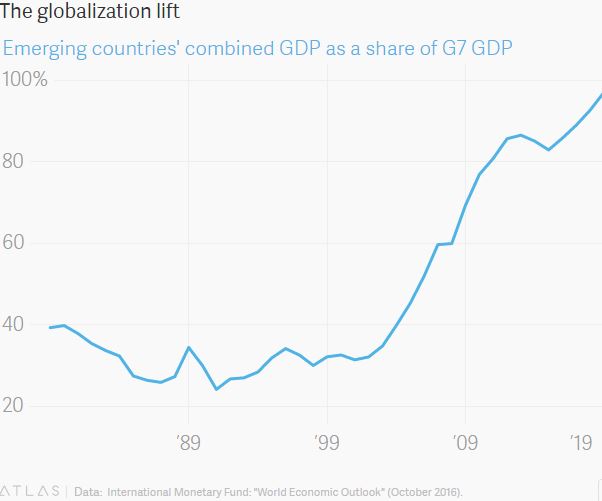

Others posit that a decline in inequality may be a motivating factor. Danny Quah, Professor of Economics at Singapore's Lee Kuan Yew School of Public Policy, and Kishore Mahbubani, the school's Dean, blame populism's rise on improved income equality across all nations. During the 1990s, a 70% income gap stood between emerging economies and the G7. That gap shrunk to under 14% in 2016 and will disappear by 2020.

Mahbubani and Quah propose that the shift in power including purchasing power away from richer nations to emerging economies and East Asia is an unsettling idea for citizens in developed nations.

Ordinary Americans care at a deep, instinctual level that they or at least their elected leaders, get to be in charge, and get to write the rules of the game, says Professor Quah. Others around the world are catching up to them, and what is now in the cards is a shared, genuinely global future one where no nation is exceptional or indispensable.

Only time will determine the shape of this shift. Nonetheless, the current anti-global mood raises a few questions for Asia, which, at least until now, has largely benefited from globalization. If a return to mercantilism accelerates, and global trade slows, will Asia pivot? And if the West steps back from pushing international solutions, will others fill those shoes?

There's an idea going around that emerging economies in Asia have grown only because Asians export to US consumers, and that consumption is too weak within Asia to support sustainable growth. But just as in every other economy, economists tell us, when disposable incomes grow, so will consumption.

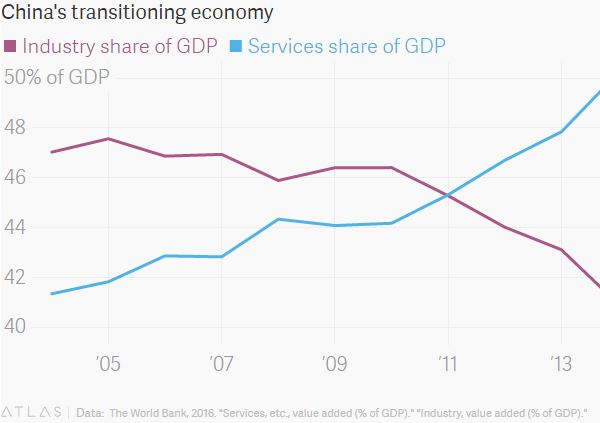

Domestic demand has remained remarkably resilient throughout most of the region, supported by rising real incomes, says Changyong Rhee, Director of the Asia and Pacific Department at the IMF. External demand won't be helped by the death of the Trans-Pacific Partnership, and China's rebalancing will continue to have ripple effects. But there's no denying that Asia's economy will continue to play a major role in the global economy as its emerging and frontier markets continue to grow.

If the US turns inward perhaps because it thinks trade is letting others win while it loses emerging Asia will seek out other security arrangements, predicts Professor Quah. Will China benefit from this new balance? It won't hurt China, no.

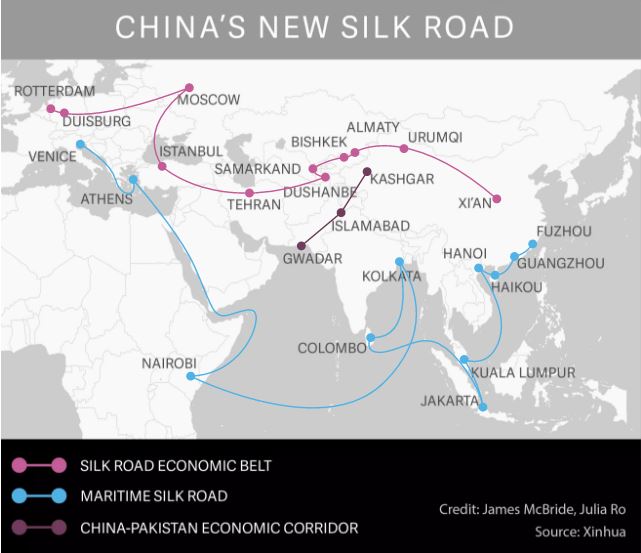

In fact, China, who would have been excluded from the TPP, will now have greater scope to boost trade with its regional partners. Asia's trade channels run deep, and will only become stronger if initiatives like One Belt, One Road' and the Regional Comprehensive Economic Partnership are successful.

Even as it grows, Asia's concentration of consumers and rapidly expanding markets will need infrastructure and industry to support them. At the same time, as Western neo-mercantilism takes shape, US companies will have to decide what their role will look like.

In an interview with the Wall Street Journal, John Dulchinos, VP of digital manufacturing at Jabil, supplier to companies like Apple and Electrolux SA, says In no other country can you scale up so quickly. You have the ability to move quickly and there's a really strong electronics supply chain in Asia centered around China.

Whether US or Asian, industries that succeed will be those that don't pit humans against machines but use the latter's speed and precision to let humans perform better. Asia has learned that lesson it's the global hub for advanced manufacturing and sophisticated logistics.

What's more, China is now the world's largest consumer market for smartphones and other gadgets. And regardless of East or West, shrewd businesses will always look to capitalize on the opportunities available to them. Asia holds many.

This article was developed by Quartz in partnership with the Lee Kuan Yew School of Public Policy and first appeared here.