Mukul Asher and Azad Bali recently published a paper in which they argued for a radical restructuring of Singapore’s system for financing retirement. Here, Azad Bali summarises the key ideas

Singapore is expected to experience rapid ageing of its population in the next two decades – since 1975, it has a below replacement rate fertility. People more than 65 years old will increase from 0.46 million in 2010, to 1.4 million 2030,

an increase of over 200 per cent in just two decades. Many will live till 85, or into their 90s. Therefore, old-age income security is increasingly becoming an important economic, social, and political issue.

Singapore’s pension system is based on two major premises. First, it is possible to finance retirement expenditure almost entirely by mandatory savings of households, which are micro-managed and intermediated by the state. Second, the pension

system should focus on mitigating absolute rather than relative poverty. This is a system with many limitations in securing old-age income security.

1. Use CPF Assets more productively to provide old age income security

One of the main purposes of mandatory savings to finance retirement expenditure is that these savings would be intermediated through financial and capital markets and increase both national savings and investments, and ultimately result

in high economic growth. Member balances, represented by the assets of the Central Provident Fund (CPF) are held mostly in non-marketable government securities. In the 25-year period ending 2011, CPF Assets have grown only

by 1.42 per cent annually in real terms (i.e. taking into account inflation). This is in sharp contrast to annual real GDP growth of 7.9 percent in the same time period. CPF Assets must be used more productively if they are to

meaningfully provide old-age income security.

2. Pool risks

There is limited risk-pooling or sharing of risks across the society to mitigate old-age poverty in Singapore. Without a system of risk-pooling, income and wealth inequalities present during the working-age are not only carried

forward, but are accentuated during retirement. This is particularly relevant for women, who as a group have higher longevity but lower labour force participation and consequently lower balances in their CPF accounts to finance their

retirement. This is further aggravated when they have to buy an annuity on retirement, whose premium is based actuarially on commercial principles varying by age and gender rather than on social insurance or solidarity principles.

There is, therefore, a need for greater redistribution and riskpooling in how retirement expenditure is financed.

3. Create social pen3. Create social pensions

A possible avenue to broaden social protection in Singapore is to explore the role of social pensions, benefits that are non-contributory and are financed by budgetary sources. However, most analysts immediately dismiss social

pensions as an option, as they are considered prohibitively expensive. What would a social pension scheme in Singapore cost? Such calculations are very difficult to do, however, are important as they inform policy debates and

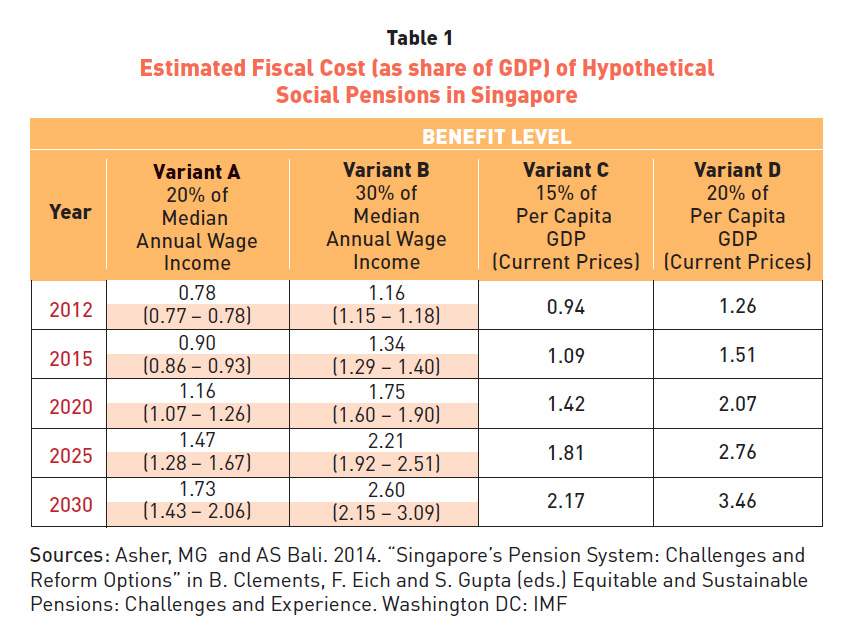

anchor expectations. Table 1 presents fiscal costs of a hypothetical, universal coverage social pension scheme on the following assumptions.

GDP is assumed to grow in nominal terms between 5 and 6 per cent. No means testing using income or assets to qualify for the social pensions are used in the estimation. Social pension benefits are restricted to citizens over the

age of 65 years and provided on an individual basis. Further, the estimation does not take into account the administrative, or compliance costs of the social pension scheme.

The four columns have different benefit levels in terms of two widely used parameters (wages and per capita GDP). Because the benefit levels are proportionate to wages or to per capita GDP, the benefits proposed enable the individual

to share in the growth of the economy. The benefit level used (20 per cent and 30 per cent of median annual wages in Variants A and B, and 15 and 20 per cent of per capita GDP in Variants C and D, respectively) is based on international experiences.

The projections indicate that with the rising share of the population being over 65 years old, and with increasing wages and incomes, the fiscal cost will increase rapidly between 2012 and 2030. Thus, assuming the benefit level

of 30 per cent of median annual wage, the fiscal cost will rise from 1.16 per cent of GDP in 2012 to 2.60 percent by 2030. The range of costs projected in the brackets for Variants A and B is due to the differential assumption of

the parameters. The range widens over time because of the compounding effects of the two parameters.

It is important to reiterate that these estimates are based on many assumptions, and more rigorous simulation exercises are needed to project actuarially fiscal costs of social pensions; however, the relevant data for such exercises

are not available easily.

The exact design of the social pension will have significant implications for the fiscal outlay required to finance it. Eligibility through means or asset tests, benefit levels, claw back through taxes, and the extent to which

partial pensions are to be paid are important policy considerations that require rigorous empirical scrutiny.

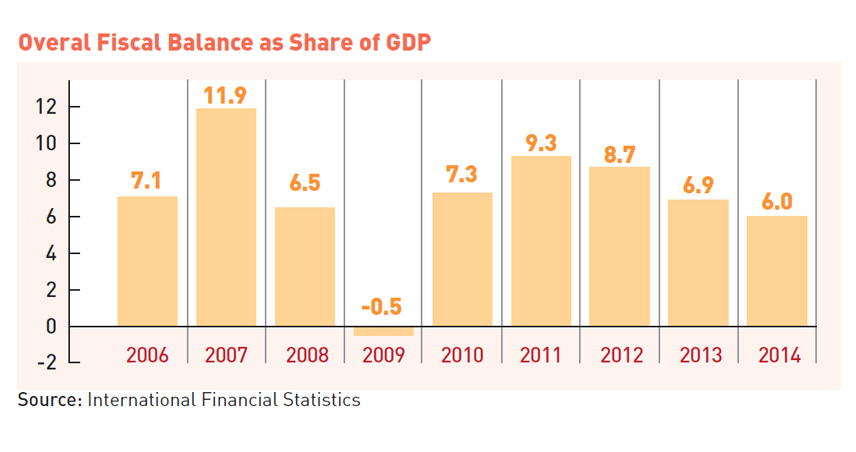

How are these proposed fiscal costs to be financed? Singapore, on average, has enjoyed structural fiscal surpluses over the past decade (Exhibit 2). This suggests that such reforms are not necessarily constrained by fiscal space

or capacity. The structural budget surpluses can help finance pension reforms, without serious reductions in expenditure on other government priorities, such as human resource development, health, and infrastructure. The main constraint

on pension reforms is not fiscal, economic, institutional, or capacity related— it is the need to assign a higher priority to reforming existing pension arrangements.

Azad Bali is a PhD Candidate at the LKY School