Income inequality in Singapore and other parts of the world has been a topic of discussion for nearly three decades, however, it has caught greater traction since 2015 – the year when the United Nations (UN) announced the 17 Sustainable Development Goals (SDGs). Over the years, there has been a massive global consensus on the disadvantages of rising inequality, its impact on the economy and society, and why policymakers should take it seriously.

A Closer Look: Income Inequality in Singapore

Singapore has been ranked among the bottom 10 countries with respect to tackling inequality by Oxfam International[1]. It has been ranked as having the third highest Gini coefficient in the world, after the United States (US) and the United Kingdom (UK), upon accounting for taxes and transfers (see Chart 1).

Source: Ministry of Finance, Singapore

Income inequality has been known to have broad implications across the spectrum, particularly political. According to Dr. Vinod Thomas, Visiting Professor at the Lee Kuan Yew School of Public Policy, Brexit and the era of Donald Trump in the United States are two such events that are widely known to have emanated from rising inequality in these countries. For Singapore, the issue of income inequality can result in a rigid and stratified social system that can make politics in the city-state vicious, potentially fracturing its social fabric, as stated by Minister K. Shanmugam.

Policymakers in Singapore and many across the world who look up to the city’s developmental model are worried. It might be time to learn from global experiences, particularly from countries in Latin America, says Professor Ravi Kanbur from Cornell University, where income inequality has been decreasing over the past few decades due to more inclusive social policies. In a recently published report by the International Panel for Social Progress (IPSP), Dr. Kanbur and his team of global experts offer deep insights into the challenge of income inequality.

Causes of Inequality

The report highlights some of the key drivers of inequality and their twin characteristic of being both deep-rooted and slow to change. Inequality tends to reproduce itself over time and exhibits significant path-dependency, accentuated by factors like

- persisting inequalities across population groups potentially affected by social stratification,

- long standing beliefs and attitudes when it comes to redistribution policies and

- the strong link between economic and political inequality and demographic dynamics

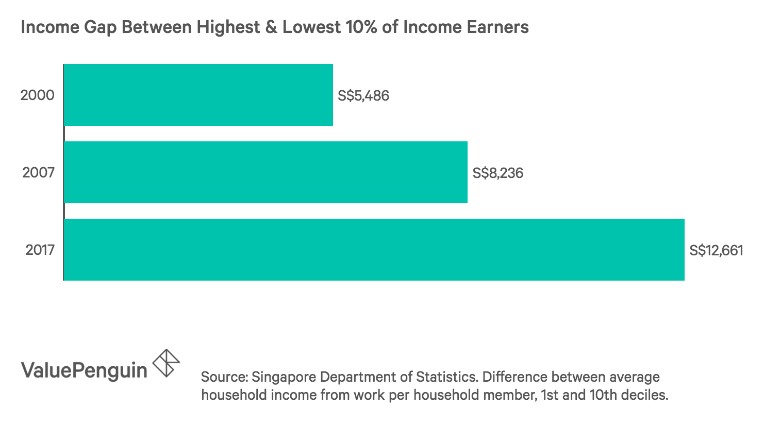

Discussing the above points further with respect to Singapore’s unique and dynamic context can help enhance our understanding a little more. Given that income inequality is measured in Singapore at the household level, we know that there are households that comprise both the top 10 percent and the bottom 10 percent of the spectrum. Considering these two groups as our focal points, we know that inequalities between these two groups have continued to increase tremendously over the past few decades (see Chart 2 below).

Irrespective of the argument that the lower-income households have seen a faster income growth in the last 10 years compared to the top 10 percentiles, the difference appears far negligible, and the benefits accrued to the top shelf of the populace is certainly not comparable to the other group. What is more important is to realise that these differences are getting more “visible” and harder to ignore. As stated by Dr. Kenneth Paul Tan, Associate Professor at the Lee Kuan Yew School of Public Policy, such cues can shape some deep-rooted concerns of the lower-income groups in terms of their identity, role and prospects for growth in future.

The second and more pertinent issue is that of meritocracy as a fundamental guiding principle of Singapore and the need to revisit and rethink its potential contribution to rising inequality in the country. This is a more difficult challenge for the leadership considering that the principle has served perfectly well in enabling the nation to transit from third world circumstances to a first world exemplar.

Lastly, the way political power is exercised and the benefits that such power allows in the form of economic gains might play a passive yet pertinent role in influencing perceptions of income inequality among the public. Moreover, it is now a key necessity for the city-state, much more than ever before, to actively pursue its social cohesion strategies - including the shaping of policy debates around inequality (explored by Dr. Mukul Asher) and a revision of standards of measurement (discussed in detail by Dr. Ng Kok Hoe). In a way, Singapore must explore and carefully shape for itself a model that extends beyond meritocracy and ensures equity based on a broader set of values that can eliminate discrimination in every form possible.

Contrary to the above discussion, it is equally right to argue that Singapore had perhaps realized its shortcomings long back and has already started working on it, despite allegations and discontent arising from the Oxfam report. The clearest reflection of this is the recent reforms in education policy which relaxes examinations for several primary and secondary grades and reserves a fifth of seats for students from non-affiliated primary schools in secondary grades. Critics however believe that until the underlying socioeconomic structure remains unchanged, educational reforms will fail to achieve their desired results.

IPSP acknowledges that any policy measures taken today to resolve inequality will bear fruit only after a span of time. According to Dr. Hui Weng Tat, Associate Professor at the Lee Kuan Yew School of Public Policy, wage depression caused in the bottom 10 quintile is the main cause for rising inequality in Singapore. He proposes minimum wage policy to be a potential solution. Despite there being greater opposition to this policy, Dr. Hui has identified ways in which it can be implemented to complement the existing in-work benefit schemes like WIS[2], WSB[3]. He also proposes new ways of enhancing the social safety nets which might have long-term impact on reducing inequality in the city-state. However, there is no silver bullet to solve an issue as complex as inequality and this is precisely the reason why many countries struggle with it. A multi-pronged social policy approach that learns from best practices elsewhere might be more beneficial, offer lesser risk and lead to the creation of sustainable solutions to the problem.

Conclusion

Singapore today has come a long way since its independence in 1965. It is now in a post-Lee Kuan Yew era where it must adapt to the changing times. Creating a legacy can be hard but continuing one can be much harder. Despite that, Singapore has already proved itself as having much leverage in being able to achieve inclusive growth in the long-term. The country’s long-standing tradition of efficiency in policy implementation should become its strength when it comes to uplifting its people - a part that feels left out of this incredible success story.

[1] Oxfam is a confederation of 20 independent charitable organizations focusing on the alleviation of global poverty, founded in 1942 and led by Oxfam International.

[2] Workfare Income Supplement (WIS)

[3] Workfare Special Bonus (WSB) (on top of WIS)

Hofmann, W. (2018, July 23). How Big of a Problem is Income Inequality in Singapore? Value Champion. Retrieved from https://www.valuechampion.sg/2018/07/how-big-problem-income-inequality-singapore

Hui, W. T. (2013). Economic growth and inequality in Singapore: The case for a minimum wage. International Labour Review, 152(1), 107-123.

International Panel on Social Progress (2018). Retrieved from https://www.ipsp.org/

Kenneth Paul Tan (2018, October 14). S’pore’s income inequality is made worse by elitist values & systematic elitism. Mothership. Retrieved from https://mothership.sg/2018/10/kenneth-paul-tan-income-inequality-sg-elitism/

Ministry of Finance, Singapore (2017, December 04). Before and after taxes and transfers: Singapore’s Gini coefficient. Retrieved from https://www.mof.gov.sg/Newsroom/Parliamentary-Replies/before-and-after-taxes-and-transfers---singapore-s-gini-coefficient