Singapore is among one of the most digitised cities in the world, with a

96.9 per cent internet penetration rate and

ranking third in digital competitiveness globally. But does this high rate of digitalisation mean that it is a thriving digital economy?

Given the current lack of consensus among countries, institutions and organisations on the parameters and definitions of what constitutes the digital economy, it is difficult to assess the true size or impact of Singapore’s digital economy.

To tackle this, the Lee Kuan Yew School of Public Policy (LKYSPP) and the Infocomm Media Development Authority (IMDA) jointly published a report titled “

Singapore Digital Economy 2023” that attempted to estimate the size of Singapore’s digital economy in order to fully understand its contributions and pace of change.

Said Associate Professor at the Lee Kuan Yew School of Public Policy, Vu Minh Khuong: “Taking stock of the digital economy is crucial. Not only does it unveil the actual size and growth rate of this dynamic component of the economy, but it also helps identify the leading and lagging sectors and facilitates meaningful benchmarking against comparable economies. The digital economy is fast-growing and very dynamic, and a profound understanding of its growth patterns and drivers is strategically important for policymakers to make informed decisions.”

A defining moment

The Singapore Digital Economy 2023 report defines the Singapore Digital Economy (SGDE) as comprising the following:

1. Value-add from the Information & Communications (I&C) sector

2. Value-add from the digitalisation of the rest of the economy (excluding the I&C sector).

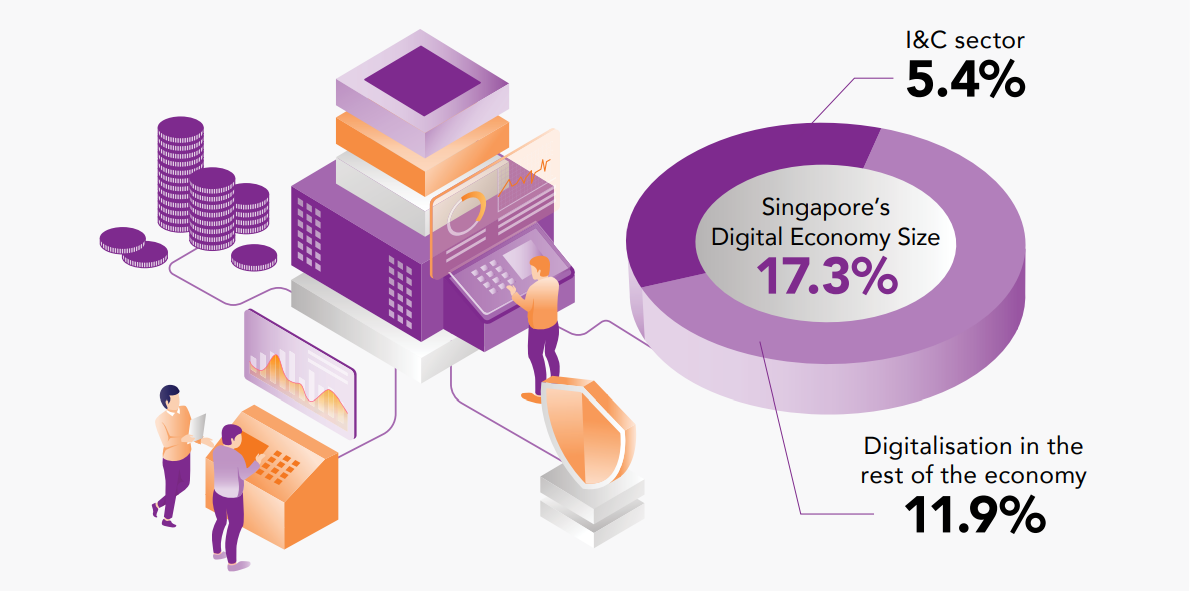

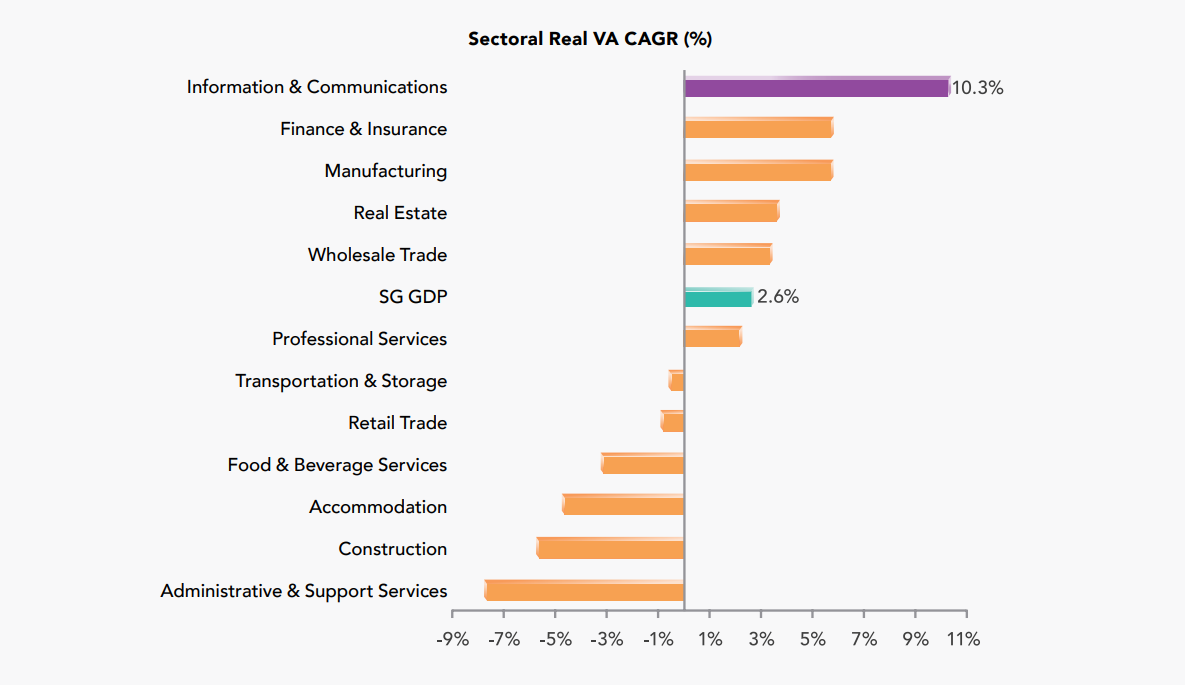

The I&C sector mainly counts businesses that provide core digital services, like telecommunications, cloud computing, software development, and the production and distribution of digital content and media. In 2022, I&C underwent significant expansion, with some verticals (i.e. games, online services and e-commerce) seeing double-digit growth of up to 70 per cent year-on-year compound annual growth rate (CAGR), largely due to the accelerated digital adoption during the COVID-19 pandemic. By year-end 2022, value-add from I&C accounted for a third of Singapore's digital economy — or 5.4 per cent of the country’s total GDP, up from 4.3 per cent in 2017.

The rest of the economy — or non-I&C sectors (i.e. finance and insurance, wholesale trade and manufacturing) — saw nearly double that contribution as they embraced new technologies. Composing about two thirds of the digital economy, their value-add delivered 11.9 per cent of Singapore’s GDP in 2022, totalling S$72.8 billion — a leap from 2017’s S$38.6 billion.

Composition of Singapore’s digital economy size (% of GDP), 2022.

Source: Singapore Digital Economy Report 2023

I&C sector value-added, CAGR growth, and share of overall economy, 2017-2022. Source: Singapore Digital Economy Report 2023Singapore’s steady digital growth

In 2022, the total value-add of Singapore's digital economy was S$106 billion — or 17.3 per cent of Singapore’s nominal GDP. This is a jump from 13 per cent in 2017.

This rapid growth is largely attributable to Singapore’s steep rate of technology adoption, which grew from 74 per cent in 2018 to 94 per cent in 2022. Similarly, the technology adoption intensity (e.g. the average number of digital technologies adopted per firm) climbed steadily from 1.7 to 2.1 over the same period.

The findings of the report also show that non-SMEs have a higher technology adoption rate than SMEs, and non-SMEs’ technology adoption intensity is double that of smaller organisations. Said Prof Vu: “SMEs’ adoption of cloud services stood at 26.5 per cent in 2022 — a marginal increase from 2017’s 22.9 per cent. Compare that to non-SMEs’ 89.3 per cent in 2022 vs. 53.9 per cent in 2017, and the difference is stark. Adoption of technologies like data analytics and AI show similar patterns, creating an urgent need to support SMEs’ digital transformation. Policy shifts that go beyond cost-benefit considerations and help foster strategic partnerships between SMEs and digitally savvy players would be key to bridging that gap.”

Digitalisation spurs the need for tech talent

As Singapore’s digital ecosystem expand, the number of people needed to power and sustain the growth grew. Total tech jobs in Singapore, comprising both I&C and non-I&C sectors, rose from 155,500 in 2017 to 201,100 in 2022, accounting for 5.2 per cent of the country’s share of total employment.

The I&C sector held 43 per cent of these jobs while the rest of the sectors accounted for 57 per cent of the jobs, signifying that tech jobs are not necessarily clustered in tech companies but spread across a range of sectors at varying paths to digitalisation.

Singaporeans hold over 70 per cent of tech jobs in Singapore and, despite steep layoffs in 2023 across the sector, tech professionals and their skill sets are likely to remain in high demand as the economy continues to power its digitalisation ambitions. Median salaries also rose substantially from S$5,512 to S$7,376 between 2017 and 2022, improving many livelihoods and making the tech space even more appealing.

How Singapore stacks up

When compared to neighbouring ASEAN countries, Singapore has become a model for digital adoption and integration. Whether in digital trade and data protection, digital skills and talent development, institutional and infrastructural readiness, or nurturing digital innovation and entrepreneurship,

Singapore’s focus on digitalisation has enabled the country’s digital economy to thrive. Despite this promise, Professor Vu noted potential challenges the country’s policymakers should be wary of. “Singapore has significantly outperformed other ASEAN countries in terms of the size and growth of the digital economy. However, given its small size, Singapore is likely to face significant challenges unless it adopts a more vigorous outward approach to promoting digital integration with other economies, especially within ASEAN, and with China and India,” he said.

The

IMD World Digital Competitiveness Ranking shows that Singapore lags behind the US and Netherlands respectively in its capacity and readiness to adopt and explore digital technologies for economic and social transformation. Though Singapore comes in third after these two countries, it has room for improvement, especially when it comes to its privacy protection laws (50th out of 64th), investment in telecommunications (58th) and immigration laws (49th).

Said Prof Vu: “To bolster its competitiveness in the knowledge pillar, Singapore should prioritise employee training, where it currently ranks 27th, versus the Netherlands' 6th place. And to enhance Future Readiness, Singapore must improve the agility of its companies, where it ranks 26th versus the Netherlands' 10th place. Let’s also not forget that addressing entrepreneurial fear of failure is imperative, which has been a long-standing challenge.”

Proactive strategy for the future

While Singapore stands out as a leading player in the rapidly changing landscape, its small population and geographical location among less advanced countries means that the city state must embrace a proactive, outward-looking and synergy-focused strategy if it wants to maintain rapid growth, said Prof Vu.

He added: “Still, in the early stages of development, Singapore should support its digital economy by engaging in regional and global partnerships, with the aim of becoming a global leader in digital innovation and development solutions.”