Concerns about trade deglobalisation continue to grapple policy makers globally. Global trade-to-GDP ratios have remained stagnant since 2008 after growing impressively for decades. Several emerging markets like India have also experienced a similar export drag after a brief rebound from the global financial crisis. Data from the RBI suggests that India's merchandise exports during the post-GFC phase dipped to about 12% of GDP in 2016-17, the lowest since 2005-06, after peaking at 17% of GDP in 2013-14. India's merchandise exports represented just 1.7% of world merchandise exports in 2016-17 and has hovered around the same range since 2011-12.

Flagship initiatives such as Make in India and a slew of measures by the central government packaged as part of the Foreign Trade Policy (FTP) 2015-20 are aimed at trying to reverse this slackening in exports, though results to date have been disappointing. For instance, the FTP set a target of increasing India's share in global trade to 3.5% by 2020 and nearly doubling the value of its exports of both merchandise and services from around US$465 billion in 2013-14 to US$900 billion by 2019-20. If anything, exports are moving in the opposite direction and the FTP targets currently look rather unrealistic.

Concentration of exports

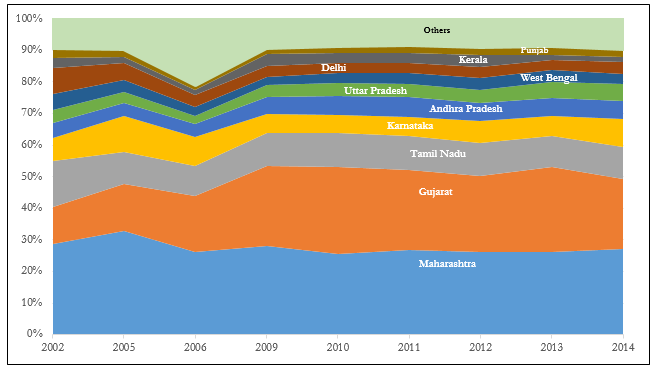

A closer look at the data reveals a heavy concentration of exports from a handful of states in India. Eleven states - Maharashtra, Gujarat, Tamil Nadu, Karnataka, Andhra Pradesh, Uttar Pradesh, Haryana, West Bengal, Delhi, Kerala and Punjab - contributed to just over 90% of India's exports between 2002 and 2014 (latest available state-level data). The composition of the leading exporting states has remained more or less the same over the years (Figure 1).

Focusing on the top four states, Maharashtra has always been consistently the highest contributor to India's overall merchandise exports, with an average share of just over 27% between 2002 and 2014. Gujarat is the other major exporter, contributing an average of 22% of India's overall exports (up from 11% in 2002). Maharashtra and Gujarat made up about half of India's exports in 2014. The Southern states of Tamil Nadu and Karnataka together contribute another 18% on average to India's overall exports. While Tamil Nadu's share declined from 15% to 10% during 2002-14, Karnataka has maintained an average share of 7.5%.

Drivers of exports

What factors drive exports from these states and in particular, what has ailed India's exports? Intuitively, one can think of at least three important factors that could impact exports: The first is world demand. We expect to see a positive relationship between higher demand for India's goods in the world market and its merchandise exports.

The second and arguably the one that receives the most attention in India is relative price competitiveness captured by movements in real effective exchange rates (REER). The impact on exports could be different depending on whether we are looking at REER movements in levels or fluctuations/volatility. If we go by the conventional understanding we would expect a REER depreciation to boost exports (and vice versa) as a weaker currency could boost price competitiveness. Similarly, higher REER volatility should deter a country's exports to the rest of the world as it increases the uncertainty of revenues from exports and could lead to higher transaction costs. However, these traditional relationships may not always hold true. Increasingly, in the world of global value chains, any positive impact on exports of a weaker currency could be dampened if such depreciation raises the cost of imported inputs. Similarly, negative effects of REER volatility may be moderated if, for instance, well-developed financial markets allow exporters to hedge.

Beyond exchange rates, a crucial driver of exports relates to the supply capacity of the country. In India, where exports are concentrated in a few selected states, it becomes even more important to have a state-level measure of supply capacity.

Exchange rates vs. supply capacity

In our latest research, we empirically examine the importance of each of these factors that can potentially determine exports from these top-exporting states. For the holistic measure capturing supply capacity of the states, we construct a sub-national competitiveness index (which we have been tracking since 2000) that measures competitiveness across multiple dimensions.

Our findings are noteworthy. Starting with world demand, consistent with our priors, we find that world demand has a positive and highly significant impact on real exports.

What about exchange rates? Our results show that REER movements in levels produce no statistically significant impact in driving exports, but volatility of REER does generate a significant and negative result. The finding that REER movements by themselves do not matter as much as volatility largely aligns with India's current exchange rate regime and its recent move towards inflation targeting whereby the RBI focuses primarily on its inflation target but does intervene in the foreign exchange market to manage excessive volatility and disruptive movements in the Rupee.

However, the single most significant policy variable that affects exports is state competitiveness. A one unit increase in our measure of state competitiveness index boosts real exports to GSDP by 0.06 percentage points, underlining its significance. As a policy exercise, we also zoom in on the physical infrastructure dimension of state competitiveness and simulate the magnitude of improvement in exports with upgraded physical infrastructure. We observe notable increases in states' exports as a result, reiterating the need for policymakers to focus on enhancing the quality of physical infrastructure.

Overall, while India's exports may be expected to recover somewhat with global growth and the RBI can do more to smoothen Rupee volatility, to a large extent, India's continued export underperformance is due to supply-side factors. Beyond what we have studied, while measures like demonetisation, rising global protectionism and relatively high domestic cost of credit, have clearly not helped the exporters, on a structural basis, policymakers can do much more on the supply-side such as addressing logistical bottlenecks to help revive exports growth. Much of these fixes need to be implemented at the state level.

Figure 1: Exports Contribution of Top 11 Sub-National Economies to India's Total Exports

This piece was first published in The Financial Express on 6 October 2017.