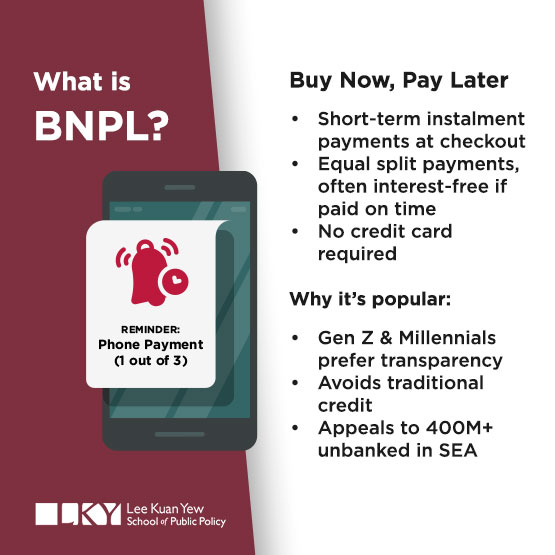

In the ever-evolving landscape of consumer finance, one concept that has gained significant traction in recent years is Buy Now, Pay Later (BNPL).

BNPL represents a departure from traditional payment methods, offering consumers an alternative to upfront payments. Unlike credit cards, BNPL functions as a short-term financing option for specific transactions, allowing users to make purchases and defer payment.

The mechanics are straightforward – consumers choose the BNPL option during checkout, and the total cost is divided into equal instalments, often with the first payment due at the time of purchase. Subsequent payments are scheduled at regular intervals until the balance is cleared.

BNPL activity in the region

BNPL has become immensely popular among younger generations, namely Gen Zs and Millennials, for several reasons. These demographics value flexibility, transparency, and an aversion to traditional credit. BNPL aligns with their desire for control over their finances, offering a convenient alternative to credit cards with no interest if payments are made on time.

It’s not just this flexibility that makes BNPL so attractive, however. The global pandemic has influenced consumer behaviour, fostering a newfound frugality and financial consciousness. Many individuals are more cautious about accumulating debt and are drawn to BNPL as a means of budgeting and managing expenses. In Southeast Asia where over 400 million people are unbanked, BNPL serves as a bridge to financial inclusion, tapping into the region's rapid internet penetration.

Southeast Asia presents a lucrative market for BNPL, with a projected market growth of US$33.6 billion by 2027. The region's unique combination of a large unbanked population and increasing internet accessibility makes it fertile ground for BNPL players.

These platforms tap into the frugality and loss aversion learned during the pandemic, attracting consumers to high-volume retail segments, such as cosmetics, that traditionally do not accommodate credit options.

The key players that dominate the BNPL landscape in Southeast Asia are:

- Singapore: Atome, Shopback, Pace

- Indonesia: Akulaku, Kredivo, Indonana

- Vietnam: Reepay, Fundiin

- Philippines: Plentina, Cashalo, Tendopay

- Malaysia: Split, Pine Labs

What is the effect of BPNL on consumers and the public?

BNPL doesn’t seem like a loan, at least on the surface. For one thing, it’s generally zero per cent interest and can feel like a risk-free option. But it can be a dangerous path to debt.

Because the initial barrier to entry is low, customers can pile purchases without realising it. A recent survey in Australia revealed that 21 per cent of BNPL users failed to make payments on time last year, representing US$33 million in fees and some debtors being forced to take out additional loans to cover their costs.

In Southeast Asia, BNPL payments are expected to grow 38 per cent by 2027 according to IDC’s How Asia Buys and Pays 2023 report. In Singapore, BNPL is predicted to be the only new digital payment which will make inroads in terms of ecommerce share while others will remain stable .

Unregulated BNPL services may expose consumers to the risk of accumulating debt beyond their means. The absence of regulations may result in inadequate consumer protections.

While BNPL services are often promoted as interest-free, late payments or default can negatively impact credit scores. Without regulation, there might be limited transparency about the potential credit implications, leaving consumers vulnerable to unforeseen consequences and can contribute to systemic risks in the financial system. If a significant number of users default on their payments, it could lead to financial instability and affect the overall health of the economy.

Should governments regulate the industry?

So, should governments regulate BNPL? It depends on several factors. One is that the industry is still relatively new and is yet to develop an identity so regulation may be some way off.

“The government may monitor the development of BNPL services but should be cautious with interventions. A key concern regarding BNPL services is the risk of overspending by consumers. This is not fundamentally different from the concern arising from using credit cards. Hence, regulations on BNPL can be based on the existing measures applied to credit cards," said Dr Xie Taojun, Senior Research Fellow and Assistant Director (Research) at the Asia Competitiveness Institute, Lee Kuan Yew School of Public Policy. "Regulators should always aim to balance improving quality of life, expanding consumer debts, and encouraging innovations in the financial industry.”

To deal with issues currently, some services such as Hoolah are implementing a risk detection system that alerts them to a customer that has overspent. That customer’s account is suspended, and they must make sure their debts are paid before they are able to use the service again.

In Singapore, authorities have taken a light, measured approach to this new phenomenon. A BNPL working group — formed by the Singapore Fintech Association (SFA) and BNPL industry players, under the guidance of the Monetary Authority of Singapore (MAS) — published a Code of Conduct in November 2022, requiring existing players to comply by November 2023.

The BNPL Code of Conduct seeks to promote industry best practices by stipulating safeguards to mitigate the risk of consumers being in heavy debt. The six BNPL companies operating under the code are Ablr, Atome, Grab, LatitudePay, SeaMoney and ShopBack.

Other Southeast Asian countries with a higher unbanked population deal with a growing number of BNPL services providing access to credit to these unreserved markets.

Vietnam for example, does not have a clear regulatory framework for BNPL providers but payments are expected to reach a transaction value of US$10.5 billion in 2028. Indonesia, whose number of unbanked stands at 77 per cent of their population, is dealing with BNPL providers charging high interest rates and late fees.

“If any intervention needs to be recommended, enhancing financial literacy and education among consumers and proper guidelines in BNPL advertisements are both important,” noted Dr Xie.

“Users of BNPL services may not have prior experience using other credit facilities. Consumers must learn to use BNPL services without increasing their debt burden. As for the service providers, regulators can ensure that the fees or interests are advertised transparently, e.g., the effective annual rates are always stated, to allow the consumers to compare the financing costs conveniently.”

While BNPL services offer tremendous potential for consumers, it comes with its own share of risk. Ultimately, it is the technology, the service and how it is used that is important, as the BNPL market in Asia grows into the billions. While these services can offer significant benefits to the unbanked, each country must invest in the right solutions to prevent BNPL debts from mounting. The industry is new but on a tremendous growth trajectory and striking a balance between innovation and safety is essential.