The proper role of markets and the state in allocation of resources and provision of the good life has long been a subject of debate. Wu Xun and M. Ramesh of the LKYSPP recently took a fresh look at the issue in policymaking with “Market Imperfections, Government Imperfections and Policy Mixes: Policy Innovations in Singapore” (Policy Sciences, September 2013).

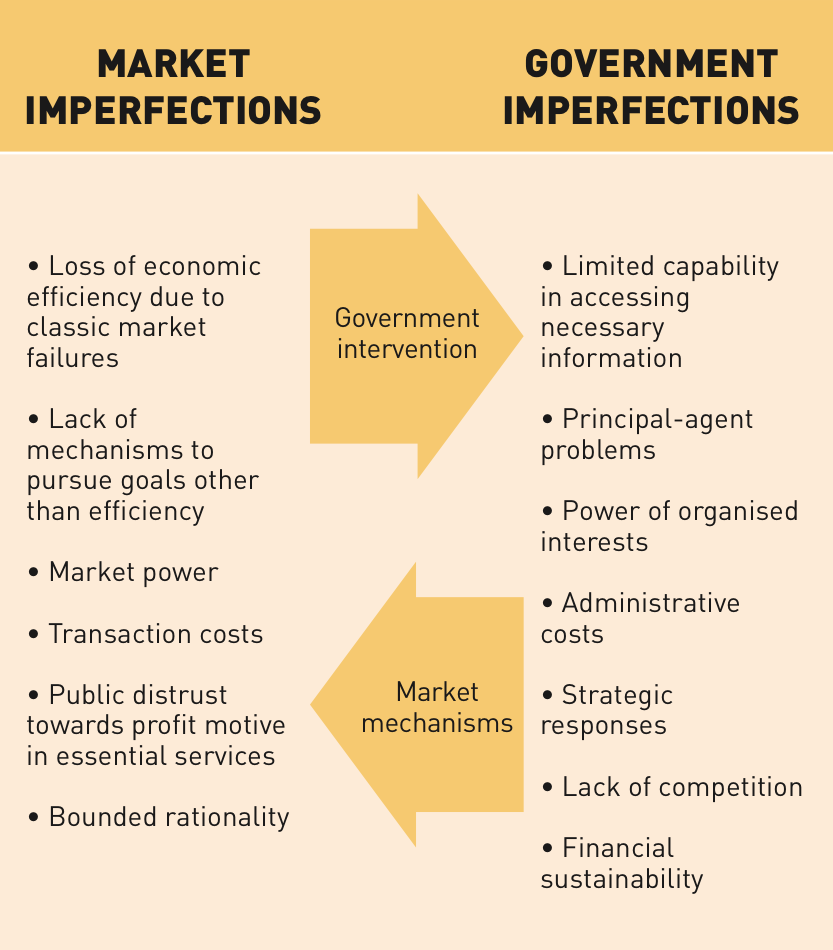

They argue that the potential of government interventions or market mechanisms as core policy instruments can be eroded by fundamental deficiencies in both. This is why both need to work together in a reciprocal relationship, a duality they call the policy mix.

When markets and states go wrong

Wu and Ramesh go beyond the conventional understanding of market failures, which is that the pursuit of private interests leads to inefficient outcomes due to monopolies, externalities, information asymmetry and the like. They identify several other market imperfections, such as the fact that markets on their own often cannot address policy goals of equity, social justice and equality, or that human beings are not actually rational economic agents but instead exhibit bounded rationality, which undermines the working of markets as intended.

Parallel to this, Wu and Ramesh also identify a set of government imperfections which tie the hands of government when addressing tough policy problems. For instance, principal-agent tensions are pervasive in government because of the challenges of measuring and monitoring performance in the public sector. Governments are also often unable to access all the information or capabilities to make the right policy decision and encounter high administrative costs in doing so.

These imperfections of market and state lead to what they term the duality paradox, as highlighted in Figure 1. Market imperfections require governments to step in through regulation, direct provision of public goods and taxation, but the effectiveness of these interventions may be undermined in turn by government shortcomings such as principal-agent problems. These government imperfections may in turn require the use of market mechanisms such as privatisation of state enterprises or implementing user charges, with all their attendant imperfections.

Wu and Ramesh argue that the duality of market and government imperfections requires a policy mix of both government interventions and market mechanisms to address many complex policy problems. For example, the presence of natural monopolies such as in the provision of telecommunications or utilities is a market imperfection. But government regulation of such monopolies leads to its own failures such as rent-seeking behaviour, which in turn require market mechanisms to offset.

Land transport in Singapore-a policy mix

To illustrate what a policy mix of government and market mechanisms looks like, Wu and Ramesh use the case of land transport in Singapore. Due to rising household incomes and unreliable public transport, the private vehicle population roughly doubled from 70,000 to 140,000 between 1960 and 1970 alone. The Singapore Government instituted a series of interventions to limit the number of cars on the roads, culminating in the Vehicle Quota System (or VQS) in 1990. Under this system vehicle owners are required to purchase a ten-year licence called a Certificate of Entitlement (COE) in order to purchase a car, and the number of COEs is determined by the Government on the basis of prevailing traffic conditions and road capacity.

But the scarcity of COEs offers rent-seeking opportunities for organised interests and even corruption, hence the need to introduce a competitive bidding system. The use of this market mechanism of auctions to allocate COEs leads in turn to criticisms of distributional inequity as lower-income households are bid out of the market for vehicles altogether. Part of the Government’s response was the rapid development of public transport as an effective alternative to cars, with high standards in route design, scheduling and safety. The authors argue that using a mix of policy instruments in controlling car ownership and usage has not only been effective, it has also provided political support for the development of public transit as a viable alternative to congested roads choked with cars.

The policy mix provides a promising framework for understanding how the strengths of markets can counter government weaknesses, and correspondingly, how the strengths of government can address market imperfections, in a reciprocal relationship that adapts to the complex policy problem at hand.

by Alvin Lee