0-33

Strongly Aligned with CN

Welcome to the Anatomy of Choice Alignment Index (AOCAI) interactive site. This index seeks to measure the alignment positions of each of the ten Southeast Asian countries vis-à-vis China and the United States, across twenty indicators – split equally into five broad domains – over a span of thirty years (1995-2024). The map view offers an overview of the overall alignments of the ten countries across the entire thirty years. More in-depth comparisons and analysis within or between countries can be undertaken in the ‘Comparison’ and ‘Country’ pages respectively. Users also have the option of adjusting the ‘weights’ of each domains on the ‘Weighting’ page.

The Index is one component of the Anatomy of Choice: Southeast Asia between the Superpowers project, led by Professors Khong Yuen Foong of the Lee Kuan Yew School of Public Policy, National University of Singapore, and Joseph Chinyong Liow of the College of Humanities and Social Science, Nanyang Technological University. The project, supported by a Singapore Social Science Research Thematic Grant (2020-2025), aims to track and explain the alignment postures and movements of the ten Southeast Asian countries in the context of the U.S.-China geopolitical rivalry in Asia.

To get the best experience, we recommend visiting the site using the latest versions of the following browsers:

Desktop:

- Chrome (version 100 or newer)

- Firefox (version 102 or newer)

- Safari (version 18.4 or newer)

- Edge (version 131 or newer)

- Opera (version 100 or newer)

- Brave (version 1.81.131 or newer)

Mobile:

- iOS (iPhone X or newer) – Safari or Chrome

- Android (Android 11 or newer) – Chrome

Note: Internet Explorer is not supported. The site may not work properly on older browser versions or beta releases.

Brunei’s overall alignment position across 1995-2024 is (48), indicating that it is in a middling position, i.e., within the hedging range. Over the last decade 2015-2024, its alignment position is (45), and over the last six years 2019-2024 its alignment position is (43). If the ‘hedging’ is defined as being in the range between (45) and (55), Brunei has gradually moved away from the hedging range in the direction of CN.

Comparing Brunei’s average alignment position between 1995-2009 against 2010-2024, it has undergone a net shift in the direction of CN (-5), from (50) to (45), which is of average magnitude relative to the rest of SEA-10.

Comparing Brunei’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-6) towards CN from (52) to (46), and subsequently (-1) to (45). Brunei’s initial shift was slightly above the average for SEA-10, whereas its subsequent shift was below the SEA-10 average.

Comparing between domains across the entire duration 1995-2024, Brunei is closest to CN in Political-Diplomatic (33), and closest to the US in Military-Security (64).

Comparing within domains from 1995-2009 against 2010-2024, Brunei has barely shifted (-1) in the Political Diplomatic domain: from (38) to (37). In terms of Military-Security, Brunei has shifted (+4) further towards the US: from (62) to (66). By contrast, Brunei has shifted significantly (-30) further towards CN in Economics-Trade: from (65) to (35). The Soft Power domain has also seen a shift (-6) towards CN, albeit less significantly: from (47) to (41). In the Signalling* domain, Brunei has shifted (+9) in the direction of the US, from (39) to (48).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Brunei has shifted most towards CN in Exports (-65) and Imports (-32). The shift in Exports being one of the largest movements recorded in the index. On the other hand, Brunei has shifted most towards the US in Security Dialogues (+17) and Negative Signals Sent* (+16).

*Brunei contains missing data for Signalling; findings need to be treated with some caution.

If ‘hedging’ is defined as being situated between (45) and (55), Brunei has just about fallen below the lower-end of the range in recent years. Brunei’s overall shift towards CN has picked up over the last 6 years. Much of Brunei’s shift has taken place in the Economics-Trade domain.

Cambodia’s overall alignment position across 1995-2024 is (38), indicating alignment with CN. Over the last decade 2015-2024, its alignment position is (30), and over the last six years 2019-2024 its alignment position is (29). Cambodia has therefore been shifting deeper into alignment with CN.

Comparing Cambodia’s average alignment position between 1995-2009 against 2010-2024, it has undergone a shift in the direction of CN (-10), from (43) to (33), which is of larger-than-average magnitude relative to the SEA-10.

Comparing Cambodia’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-5) towards CN from (45) to (40), and subsequently (-9) to (30). The extent of the latter shift is particularly notable for being the largest magnitude relative to the SEA-10 for that period.

Comparing between domains across the entire duration 1995-2024, Cambodia is closest to CN in Signalling (28), and closest to the US in Military-Security (47).

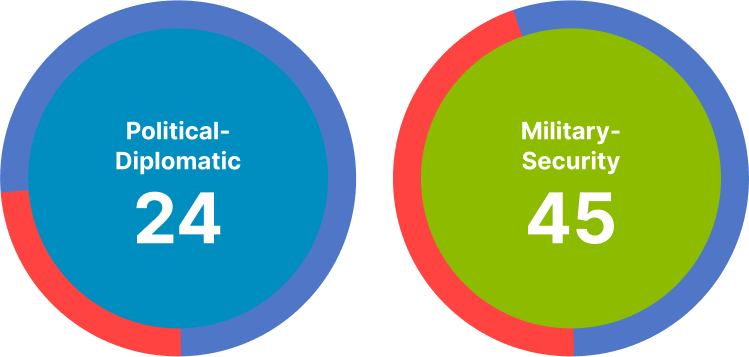

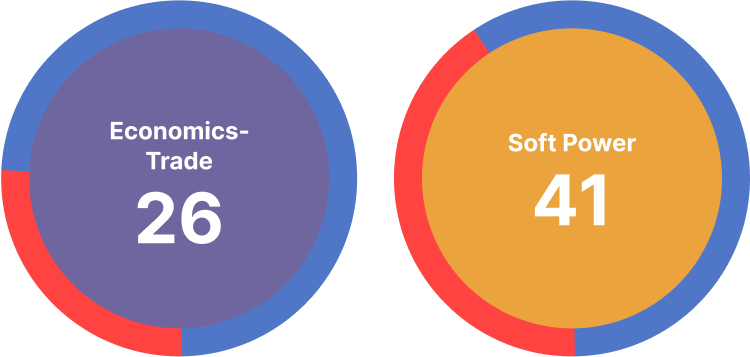

Comparing within domains from 1995-2009 against 2010-2024, Cambodia has shifted significantly further toward CN in the Political Diplomatic domain (-12): from (36) to (24). In terms of Military-Security, Cambodia has shifted in CN’s direction (-4), from (49) to (45). Cambodia’s most significant shift comes in the Economics-Trade domain (-31), from (57) to (26). The Soft Power domain has also witnessed a shift towards CN (-7), from (48) to (41). Signalling is the only domain that has seen a shift in the US’ direction (+4), from (26) to (30).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Cambodia has shifted most towards CN in Foreign Debt (-74) and Foreign Investment (-54), with both shifts being one of the largest movements recorded in the index. On the other hand, Cambodia has shifted most towards the US in Negative Received (+18) and Military Exercises (+12).

Cambodia has over the last decade shifted further into CN’s camp, across nearly every domain. Furthermore, much of Cambodia’s shift has taken place over the last decade or so, in contrast to the slowing rate of much of SEA-10. As a whole, Cambodia does not appear to be hedging; its marginal shift toward the US in Signalling is far outweighed by shifts in the other direction towards CN in all other domains. Cambodia’s alignment positions and movements towards CN may be somewhat underestimated, given that the index has been unable to incorporate Foreign Aid, where CN looms particularly large.

Indonesia’s overall alignment position across 1995-2024 is at the midpoint (50), indicating that it is equidistant from both superpowers and solidly within the hedging range. Over the last decade 2015-2024, its alignment position is (44), and over the last six years 2019-2024 its alignment position has remained at (44). If the ‘hedging’ is defined as the range between (45) and (55), Indonesia has drifted out of the hedging range in the direction of CN.

Comparing Indonesia’s average alignment position between 1995-2009 against 2010-2024, it has undergone a significant shift in the direction of CN (-12), from (-56) to (44); the largest magnitude relative to the SEA-10 overall.

Comparing Indonesia’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-10) towards CN from (58) to (48), and subsequently (-3) to (44). The former shift is particularly notable for being of the largest magnitude relative to SEA-10 for the period. In contrast to Cambodia’s comparatively recent shift towards CN over the last decade, much of Indonesia’s shift towards CN took place earlier, in the 2000s.

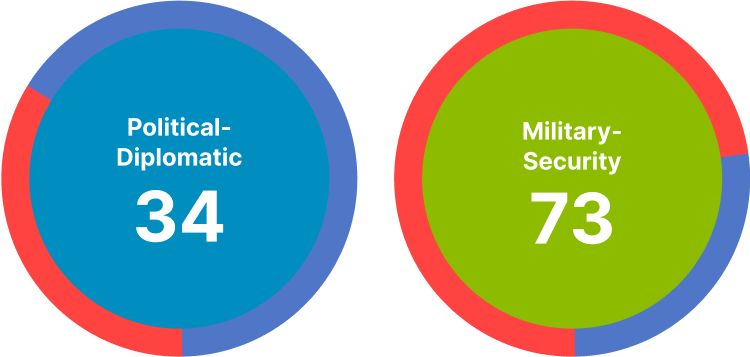

Comparing between domains across the entire duration 1995-2024, Indonesia is closest to CN in Political-Diplomatic (34), and closest to the US in Military-Security (73).

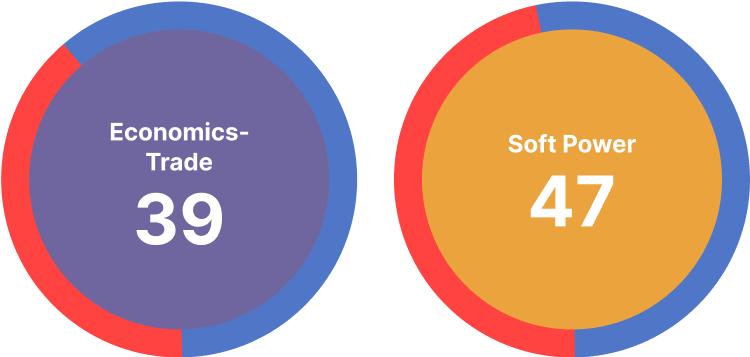

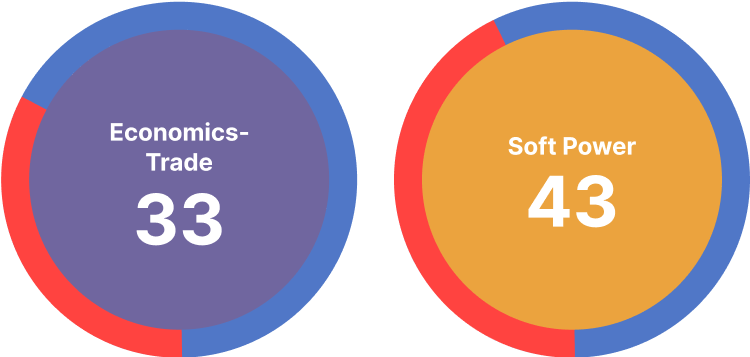

Comparing within domains from 1995-2009 against 2010-2024, Indonesia has shifted towards CN in the Political Diplomatic domain (-4): from (36) to (32). In terms of Military-Security, Indonesia has shifted significantly in CN’s direction (-13), from (79) to (66). Indonesia’s most significant shift comes in the Economics-Trade domain (-34), from (67) to (33). The Soft Power domain has also witnessed a shift towards CN (-10), from (60) to (50). Signalling has barely witnessed a shift (0), from (38) to (38).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Indonesia has shifted most towards CN in Foreign Debt (-57) and Inbound Tourists (-47). The shift in Foreign Debt is one of the largest movements recorded in the index. On the other hand, Indonesia has shifted most towards the US in Regime Type (+20) and UN Voting Alignment (+6).

Indonesia’s equidistant alignment position when measured across the entire duration 1995-2024 may suggest that it is hedging. However, compared across different periods, Indonesia has in fact shifted the most in CN’s direction. This shift is especially prominent in the Economics-Trade domain, and it is also notable that Indonesia is the sole country to have not shifted towards the US in any domain. That said, its drift towards CN appears to have slowed over the last decade.

Laos’ overall alignment position across 1995-2024 is (29), indicating deep alignment with CN. Over the last decade 2015-2024, its alignment position is (26), and over the last six years 2019-2024 its alignment position remains at (26). Across all periods, it is the second-closest country to CN, with only Myanmar consistently being closer.

Comparing Laos’ average alignment position between 1995-2009 against 2010-2024, it has undergone a shift in the direction of CN (-8), from (33) to (25), which is of larger-than-average magnitude relative to the SEA-10.

Comparing Laos’ average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-10) towards CN from (36) to (26), and subsequently stopped moving (0), remaining at (25). The former shift is notable for being one of the largest shifts relative to the rest of SEA-10 for the period.

Comparing between domains across the entire duration 1995-2024, Laos is closest to CN in Economics-Trade (17), and closest to the US in Military Security (39).

Comparing within domains from 1995-2009 against 2010-2024, Laos has shifted marginally towards CN in the Political Diplomatic domain (-2): from (30) to (28). In terms of Military-Security, Laos has shifted significantly in CN’s direction (-16), from (47) to (31). Laos’ shift towards CN in the Economics-Trade domain is also somewhat significant (-12), from (23) to (11). The Soft Power domain has likewise seen a significant shift towards CN (-14), from (39) to (25). Signalling is the only domain to have seen a shift in the US’ direction, albeit a rather marginal one (+2), from (28) to (30).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Laos has shifted most towards CN in Military Exercises (-40) and Exports (-34). On the other hand, Laos has shifted most towards the US in Negative Sent (+25).

Laos has long been deeply aligned with CN, and the figures suggest that it is shifting deeper into CN’s orbit, although the rate with which this has proceeded has sharply decreased over the last decade or so. Nevertheless, it is likely that the index has somewhat underestimated the true extent of Laos’ shift given the it does not incorporate Foreign Aid data, where CN looms large, particularly given the suite of infrastructure projects that Vientiane has signed onto.

Malaysia’s overall alignment position across 1995-2024 is at the midpoint (50), indicating that it is equidistant from both superpowers and within the hedging range. Over the last decade 2015-2024, its alignment position is (46), and over the last six years 2019-2024 its alignment position is (46), which suggests that Malaysia continues to remain within the hedging range, albeit at the margins.

Comparing Malaysia’s average alignment position between 1995-2009 against 2010-2024, it has undergone a shift in the direction of CN (-5), from (52) to (47), which is of average magnitude relative to SEA-10.

Comparing Malaysia’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-1) towards CN from (52) to (51), and subsequently (-5) to (46). Malaysia’s lack of movement in the initial period is unusual, as most of the SEA-10 experienced a fairly significant shift during this period. By contrast, however, Malaysia’s subsequent shift towards CN is of above-average magnitude relative to the SEA-10 for the latter time period; over the last decade, only Cambodia has shifted more towards CN.

Comparing between domains across the entire duration 1995-2024, Malaysia is closest to CN in both Political-Diplomatic (34) and Signalling (34). On the other hand, Malaysia is closest to the US in Military-Security (79).

Comparing within domains from 1995-2009 against 2010-2024, Malaysia has shifted marginally towards US in the Political Diplomatic domain (+2): from (33) to (35). In terms of Military-Security, Malaysia has shifted in CN direction (-4), from (81) to (77). Malaysia’s most significant shift towards CN comes in the Economics-Trade domain (-25), from (64) to (39). The Soft Power domain has also witnessed a shift towards CN (-6), from (53) to (47). By contrast, the Signalling has seen a significant shift in the direction of the US (+10), from (29) to (39).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Malaysia has shifted most towards CN in Foreign Investment (-43) and Imports (-32). On the other hand, Malaysia has shifted most towards the US in Official Visits (+17) and Negative Signals Sent (+16).

Malaysia’s middling overall position suggests that it is indeed hedging, although if present trends continue, it may eventually tip over into alignment with China. Malaysia’s drift towards CN is particularly pronounced in the Economics-Trade domain.

Myanmar’s overall alignment position across 1995-2024 is (25), indicating that it is deeply aligned with CN. Over the last decade 2015-2024, its alignment position is (22), and over the last six years 2019-2024 its alignment position is (23). Across all periods, Myanmar appears to consistently be the country most closely aligned with CN.

Comparing Myanmar’s average alignment position between 1995-2009 against 2010-2024, it has undergone a shift in the direction of CN (-3), from (26) to (24), which is of below-average magnitude relative to SEA-10. To be sure, it was already deeply aligned with CN in the 1995-2009 period.

Comparing Myanmar’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-4) towards CN from (28) to (24), and subsequently (-2) to (22). In both instances, Myanmar’s shift is of below-average magnitude relative to SEA-10.

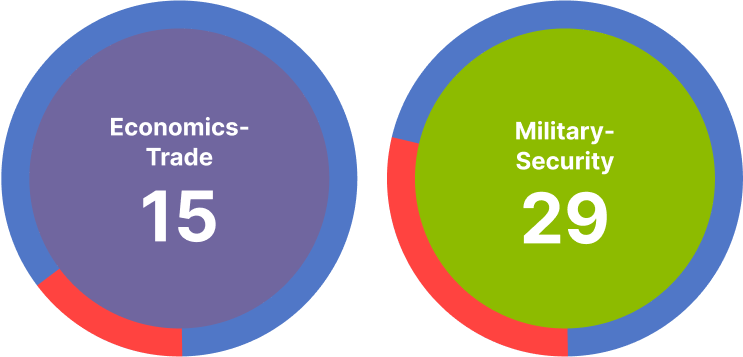

Comparing between domains across the entire duration 1995-2024, Myanmar is closest to CN in Economics-Trade (15), and closest to the US in Military Security (29) and Soft Power (29).

Comparing within domains from 1995-2009 against 2010-2024, Myanmar has shifted somewhat significantly towards US in the Political Diplomatic domain (+11): from (19) to (30). By contrast, in terms of Military-Security, Myanmar has shifted significantly in CN’s direction (-17), from (38) to (21). For Economics-Trade, Myanmar has shifted significantly in CN’s direction (-11), from (21) to (10). The Soft Power domain has likewise witnessed a significant shift in CN’s direction (-11), from (34) to (23). Signalling on the other hand has undergone a significant shift in the US’ direction (+14), from (21) to (35).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Myanmar has shifted most towards CN in Military Exercises (-44), Inbound Tourists (-32), and Cultural Institutions (-32). On the other hand, Myanmar has shifted most towards the US in Negative Sent (+25) and Business Associations (+21).

Myanmar has long been deeply aligned with CN, and in recent decades has moved even closer to CN, albeit having done so at a consistently below-average-rate relative to the SEA-10. Myanmar’s shift towards CN may be somewhat underestimated in the Economics-Trade domain, given that significant amounts of Foreign Aid from CN are likely to have been received.

Philippines’ overall alignment position across 1995-2024 is (62), indicating that it is aligned with the US, the only SEA-10 country to occupy such a position. Over the last decade 2015-2024, its alignment position is (58), and over the last six years 2019-2024 its alignment position is (60).

Comparing Philippines’ average alignment position between 1995-2009 against 2010-2024, it has undergone a shift in the direction of CN (-4), from (64) to (60), which is of below-average magnitude relative to SEA-10.

Comparing Philippines’ average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-8) towards CN from (68) to (60), and subsequently (-2) to (58). The former shift is notable for being of above-average magnitude relative to SEA-10.

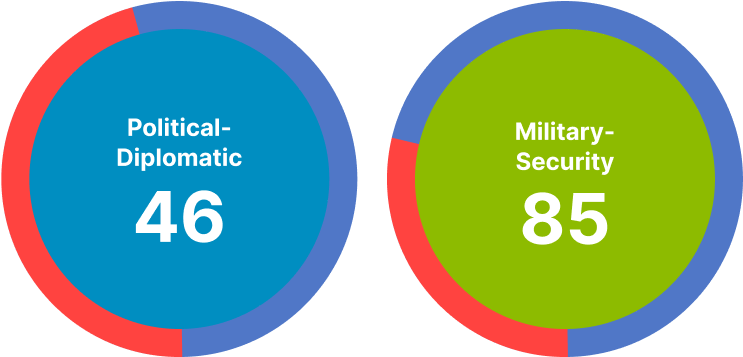

Comparing between domains across the entire duration 1995-2024, Philippines is closest to CN in Political-Diplomatic (46), and closest to the US in Military-Security (85).

Comparing within domains from 1995-2009 against 2010-2024, Philippines has shifted marginally towards the US in the Political Diplomatic domain (+2): from (45) to (47). In terms of Military-Security, Philippines has also shifted in US direction (+6), from (81) to (87). Philippines’ shift in the Economics-Trade domain towards CN is particularly significant (-31), from (69) to (39). By contrast, the Soft Power domain has seen a significant shift towards CN (-13), from (83) to (70). Signalling on the hand has witnessed a significant shift towards the US (+16), from (42) to (58).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Philippines has shifted most towards CN in Foreign Debt (-55) and Imports (-35). On the other hand, Philippines has shifted most towards the US in Negative Received (+25) and Negative Sent (+21).

The Philippines’ overall alignment position suggests that it is US-aligned. Notably, while this was clearly so in the 1990s, the early-to-mid 2000s – during Gloria Arroyo’s presidency – saw a significant shift towards CN. By contrast, Benigno Aquino’s presidency (2010-2016) did see a swing towards the US, and subsequently, Rodrigo Duterte’s (2016-2022) tenure did register a swing towards CN. Although the index only captures 2 years of the Marcos Jnr. presidency, it does suggest that the Philippines has pivoted back towards the US.

Singapore’s overall alignment position across 1995-2024 is (51), indicating that it is within the hedging range. Over the last decade 2015-2024, its alignment position is (48), and over the last six years 2019-2024 its alignment position is (48).

Comparing Singapore’s average alignment position between 1995-2009 against 2010-2024, it has undergone a shift in the direction of CN (-6), from (54) to (48), which of average magnitude relative to SEA-10. Interestingly, the 6 point shift occurs within the hedging range.

Comparing Singapore’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-7) towards CN from (56) to (49), and subsequently (-1) to (48). Singapore’s initial movement is of above-average magnitude relative to SEA-10, whereas its later shift is by contrast of below-average magnitude relative to SEA-10 for their respective periods. In other words, the majority of Singapore’s movement towards CN took place pre-2015.

Comparing between domains across the entire duration 1995-2024, Singapore is closest to CN in Political-Diplomatic (41), and closest to the US in Military-Security (72).

Comparing within domains from 1995-2009 against 2010-2024, Singapore has shifted towards US in the Political Diplomatic domain (+6): from (38) to (44). In terms of Military-Security, Singapore has not moved (0), from (72) to (72), indicating continued alignment with the US. Singapore’s shift in CN’s direction in the Economics-Trade domain is substantial (-15), from (61) to (46). The Soft Power domain has likewise seen significant shift in CN’s direction (-12), from (49) to (36). Signalling has also seen a shift towards CN (-7), from (49) to (42). The latter is interesting, as Singapore is the sole country to have shifted towards CN in the signalling domain.

In terms of indicators, when 1995-2009 is compared against 2010-2024, Singapore has shifted most towards CN in Cultural Institutions (-33) and Exports (-24). On the other hand, Singapore has shifted most towards the US in Official Visits (+14) and UN Voting Alignment (+13).

Singapore’s overall alignment position measured across the entire duration suggests that it is within the hedging range. Much of Singapore’s shift towards CN took place between the 2000s and early-2010s; since then, however, it has shifted slightly towards the US, particularly between 2013-2018. If Singapore continues to maintain its middling position, it may have a strong claim to be ‘hedging’.

Thailand’s overall alignment position across 1995-2024 is (47), indicating that it is within the hedging range. Over the last decade 2015-2024, its alignment position is (42), and over the last six years 2019-2024 its alignment position is (43). This suggests that Thailand has moved out of the hedging range and into alignment with CN.

Comparing Thailand’s average alignment position between 1995-2009 against 2010-2024, it has undergone a shift in the direction of CN (-7), from (51) to (44); which is of larger-than-average magnitude relative to the SEA-10.

Comparing Thailand’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (-7) towards CN from (53) to (46), and subsequently (-4) to (42). In both instances, Thailand’s shift is of above-average magnitude relative to SEA-10.

Comparing between domains across the entire duration 1995-2024, Thailand is closest to CN in Signalling (34), and closest to the US in Military-Security (61).

Comparing within domains from 1995-2009 against 2010-2024, Thailand has shifted towards CN in the Political Diplomatic domain (-4): from (42) to (38). In terms of Military-Security, Thailand has barely shifted (+1), from (60) to (61). Thailand has shifted significantly towards CN in the Economics-Trade domain (-17), from (64) to (47). The Soft Power domain also has seen a significant shift in CN’s direction (-20), from (55) to (35). Signalling by contrast has seen a shift in the US’ direction (+6), from (31) to (37).

In terms of indicators, when 1995-2009 is compared against 2010-2024, Thailand has shifted most towards CN in Imports (-31), Cultural Institutions (-31), and Regime Type (-31). On the other hand, Thailand has shifted most towards the US in Security Dialogues (+37) and Negative Sent (+16).

Thailand’s initial middling position has shifted over the past two decades, and as it stands over the last decade, has already tipped over into alignment with CN. That said, despite having steadily and consistently drifted towards CN since the 2000s, this movement has stalled somewhat over the last 6 years, with the latter witnessing a marginal shift towards the US. Whether this suggests that ‘hedging’ is making a slow comeback is an open question.

Vietnam’s overall alignment position across 1995-2024 is (43), indicating a slight lean towards CN, although it is not far from the hedging range. Over the last decade 2015-2024, its alignment position is (45), and over the last six years 2019-2024 its alignment position is (44), which suggests that Vietnam is in, or within touching distance of, the hedging range.

Comparing Vietnam’s average alignment position between 1995-2009 against 2010-2024, it has undergone a marginal shift in the direction of US (+4), from (41) to (45), the sole Southeast Asian country to have done so.

Comparing Vietnam’s average alignment position between 1995-2004, 2005-2014, and 2015-2024, it has undergone a shift of (+4) towards US from (40) to (44), and subsequently (+1) to (45). In both instances, Vietnam’s shift bucks the general SEA-10 trend of moving towards CN.

Comparing between domains across the entire duration 1995-2024, Vietnam is closest to CN in Political-Diplomatic (29), and closest to the US in Military-Security (57).

Comparing within domains from 1995-2009 against 2010-2024, Vietnam has shifted towards the US in the Political Diplomatic domain (+7): from (26) to (33). In terms of Military-Security, Vietnam has similarly shifted in the US’ direction (+10), from (52) to (62). By contrast, Vietnam has shifted significantly towards CN in the Economics-Trade domain (-14), from (47) to (33). The Soft Power domain has seen a marginal shift towards CN (-3), from (46) to (43). Signalling, on the other hand, has witnessed a significant shift towards the US (+21), from (34) to (55), one of the largest in terms of magnitude by our index.

In terms of indicators, when 1995-2009 is compared against 2010-2024, Vietnam has shifted most towards CN in Foreign Debt (-30) and FDI (-20). On the other hand, Vietnam has shifted most towards the US in Negative Sent (+51) and Aggression (+30). The shift in Negative Sent being one of the largest movements of any indicator towards the US in the index.

Vietnam has shifted from being comparatively more aligned with CN towards the ‘hedging range’. It is particularly notable for being the sole country to have shifted away from CN and towards the US; rowing against the tide, as it were. Most of Vietnam’s shift towards the US took place between 2007-2012 – since then, it has barely moved. If Vietnam maintains this middling position, it may have a strong claim to be ‘hedging’.

This website is best viewed on larger screens.

This website is not supported on your browser.

We detected that you are using Internet Explorer. This website is not compatible with Internet Explorer and may not function properly.

For the best experience, please use one of these modern browsers:

You can continue using the site, but may not work as expected.